At the end of last year, an interesting discussion emerged in professional circles, but it has not yet provided a clear solution. The debate between the Chamber of Tax Advisors of the Czech Republic and the General Financial Directorate (GFD) concerned whether an implied additional tax assessment decision included in the tax file within the last 12 months of the tax assessment period can extend this significant period by one year.

Actions extending the tax assessment period

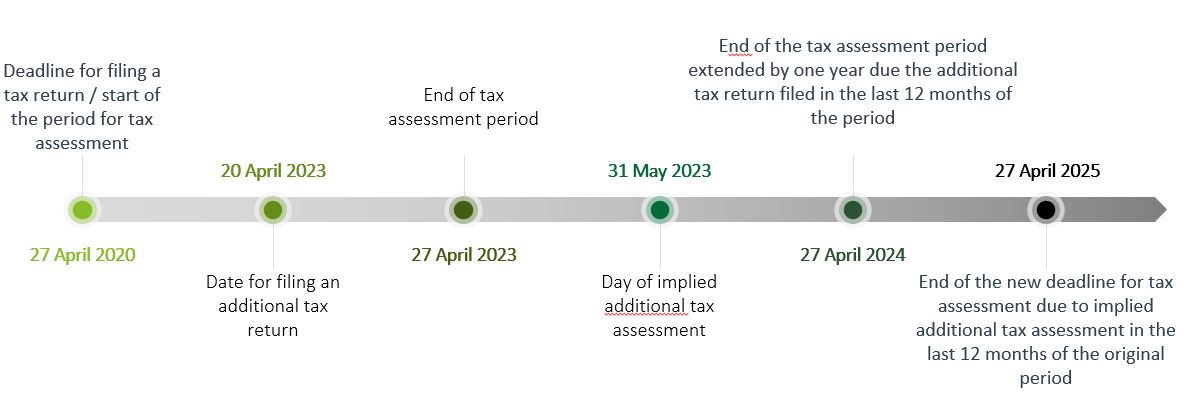

The basic period for tax assessment lasts three years and starts on the day following the deadline for filing the tax return. The tax code, however, stipulates that certain actions by the taxpayer or the tax authority extend the tax assessment period by one year, provided they are performed in the last 12 months of the period. These actions include the submission of a additional tax return or the notification of a tax assessment decision.

An example would be the submission of an additional VAT return for the tax period of March 2020, whose tax assessment period started running on 27 April 2020 and would have expired on 27 April 2023. However, if the taxpayer submits an additional tax return within the last 12 months of the period, the preclusive period is extended to 27 April 2024.

Repeated extension of the tax assessment period

The disputed issue is whether, when less than 12 months remain until the end of the tax assessment period, an implied additional tax assessment can extend the tax assessment period by another year, i.e., until 27 April 2025. Implied additional tax assessment involves determining the tax based on the figures provided in the additional tax return, whereby the additional tax assessment decision is not actually delivered to the taxpayer but is instead recorded in the tax file. In such a case, the Tax Code considers the date of assessment to be the last day of the period for filing the additional tax return (fiction of delivery).

In our case, the additional VAT return for the taxable period of March 2020 was submitted on 20 April 2023 (with the ascertainment date in April 2023), thus extending the tax assessment period to 27 April 2024. The implied additional assessment would occur on 31 May 2023, raising the question of whether it would lead to further extending the tax assessment period to 27 April 2025.

GFD’s opinion

The GFD holds the view that even the inclusion of the additional tax assessment decision in the file extends the tax assessment period by another year. The GFD is convinced that even delivery of the additional tax assessment decision by fiction is a legitimate way of notifying the tax assessment.

Given that there is currently no direct case law of the administrative courts on this matter, it is advisable, out of caution, to consider that the period for tax assessment may be extended by up to 2 years when filing an additional s tax return at the very end of the tax assessment period. Over time, this question will likely need to be addressed by the Supreme Administrative Court in case of a potential dispute.