From 1 January 2023, a new amendment of the Income Tax Act and VAT Act and other related acts should come to force. A draft amendment to the Income Tax Act has been approved by the Chamber of Deputies and has recently been referred to the Senate for approval. In this article, we will focus on the changes this amendment may bring with respect to lump sum tax and gratuitous acquisition of a co-ownership interest in fixed assets from a municipality or from a taxpayer of which the municipality is a member or founder. Further, we will describe what proposals are included in the VAT Act amendment.

Income Tax Act Amendment – Changes to the Lump sum Tax

The Income Tax Act amendment, if approved, will bring more options to access the lump sum tax for taxpayers – businessowners.

Currently, businessowners may pay taxes and social security and healthcare contributions as a lump sum as long as their income does not exceed CZK 1 million per calendar year while also meeting other requirements for the lump sum tax as defined in Section 7 a) of the Income Tax Act. Many taxpayers find this to help them both administratively (the taxpayer does not have to file tax returns or reports to social security and healthcare authorities) and financially.

The amendment should expand the number of taxpayers who may opt for the lump sum tax regime, as the threshold for eligibility should increase to CZK 2 million following the increase of the limit for VAT registration. At the same time, there will be three lump sum tax categories – depending on the amount and character of the taxpayer’s income.

Let’s quickly summarise the requirements for utilising the lump sum tax from 1 January 2023 and describe the individual lump sum tax categories.

As of 1 January 2023, a taxpayer who wants to use the lump sum tax regime must meet the following requirements:

- Is a self-employed person.

- Is not a VAT payer.

- Is not a partner in a public limited company or a general partner in a limited partnership.

- Does not have income from employment activities as of the first day of the reporting period, except for income taxed using a special tax rate.

- Has only tax-exempt income, except for income from self-employment, income that is not taxed and income taxed using a special tax rate.

- Has income from capital assets, rent and other income as long as the total amount does not exceed CZK 50,000, in addition to the above income.

- Taxpayer will timely notify the Tax Authority on its entry into the lump sum regime and chooses the lump sum regime category.

The taxpayer has to announce the entry into the lump sum scheme by 10 January of the year in question (for 2023, 10 January 2023), and at the same time, from 1 January 2023, the taxpayer sets the bracket of the lump-sum scheme. In determining the bracket, the taxpayer will base the amount of income received in the previous year.

A taxpayer whose income from self-employment for the previous tax year did not exceed CZK 1 million will be able to apply for the first bracket, as well as a taxpayer with income from self-employment up to CZK 1.5 million, if at least 75% of such income consists of income from agricultural production, forestry and water management, income from a craft business or another trade business. Finally, a taxpayer with income from self-employment of up to CZK 2 million may also apply for the first bracket, if at least 75% of this income is from agricultural production, forestry and water management or income from a craft business.

A taxpayer whose income from self-employment did not exceed CZK 1.5 million in the previous tax year will be able to apply for the second bracket, irrespective of the independent activity from which it originates. The increased limit of CZK 2 million applies to taxpayers who had 75% of their income from agricultural production, forestry and water management or income from a craft or another trade business.

All taxpayers who meet the conditions for entering the lump sum regime and whose income from self-employment does not exceed CZK 2 million will be able to access the third bracket.

What to do if the bracket changes during the year?

If the taxpayer’s income in a given year is such that the taxpayer would also qualify for a lower lump-sum tax bracket, the taxpayer has the option of filing a notice of a different lump-sum tax rate. On the basis of the notification, the tax and social security and health insurance contributions will be calculated under the lower bracket and an overpayment of income tax and social security and health insurance contributions will arise. Consequently, the taxpayer will need to apply for a refund for the overpayment of tax and social security and health insurance contributions at the tax office, as the lump-sum tax is paid into the tax office’s bank account.

If, on the other hand, the taxpayer exceeds the applicable income for their bracket, then they are obliged to notify the tax office of a different amount of lump sum tax. The amounts of the lump sum tax and insurance contributions will be higher, and the taxpayer is obliged to pay the difference in tax and insurance contributions by the deadline for filing the tax return. If the taxpayer did not make the notification of the change to the higher bracket, then his tax would not be equal to the lump sum tax, the lump sum scheme would be terminated, and he would have to file his tax return and social security and health insurance reports.

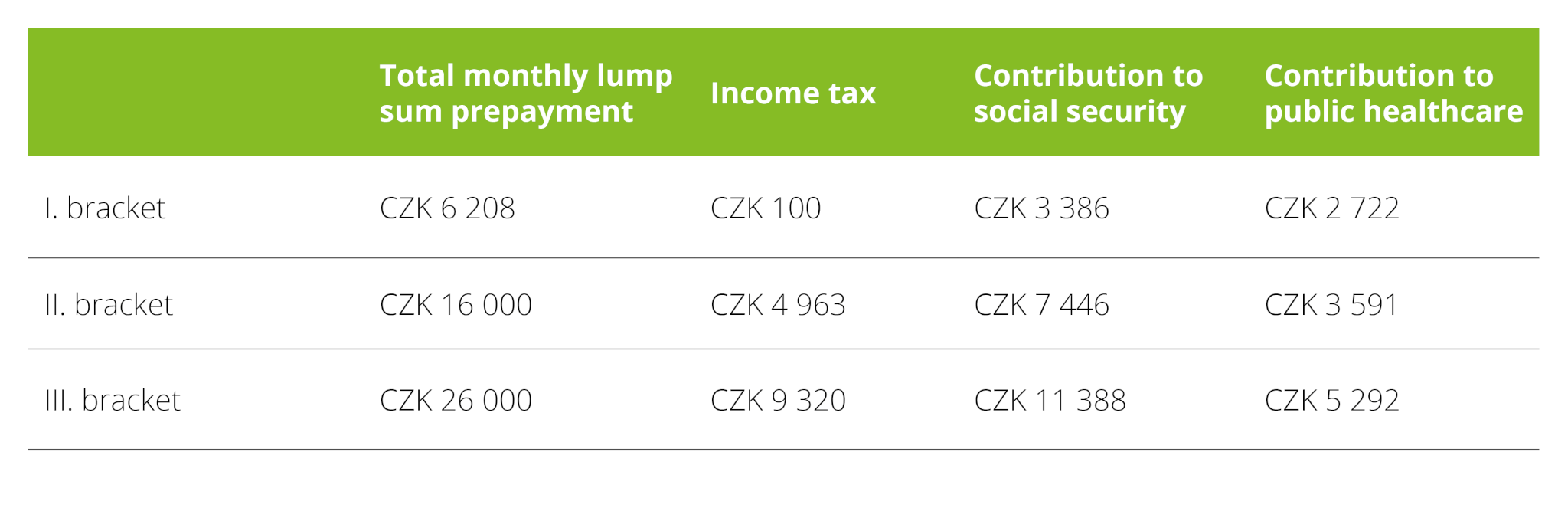

The amount of lump sum prepayments and, if the conditions are met, the final tax and social security and health insurance premiums for the month:

Amendment to the Income Tax Act – gratuitous acquisition of a co-ownership interest in fixed assets from a municipality or from a taxpayer of which the municipality is a member or founder

The draft amendment to the Income Tax Act from 1 January 2023 also includes an extension of the exemption of tax-exempt income, i.e. the exemption of gifts from personal income tax, to include income of a natural person in the form of a gratuitous acquisition of a co-ownership interest in fixed assets from a municipality or from another taxpayer of which the municipality is a member or founder, provided that the two conditions set out below are met.

The first condition for exemption is the fact that the construction of the fixed asset was subsidised from the state budget in the period from 1995 to 2007 through a programme supporting the construction of rental flats and technical infrastructure or from the State Housing Development Fund pursuant to Government Regulation No. 481/2000 Coll., on the use of the State Housing Development Fund in the form of a subsidy to cover part of the costs associated with the construction of flats, as amended.

The second condition is that the transfer of the fixed asset to another person has been prohibited for a specified period of time by the terms of the grant and is the first transfer after the expiry of that period, with the transfer serving to place the fixed asset in the ownership of an individual.

Acquisition of a co-ownership share may occur not only from the municipality itself, but also, for example, from a voluntary association of municipalities, a housing cooperative or a contributory organisation.

Furthermore, it is necessary that the transfer is gratuitous, its purpose being to transfer the co-ownership interest to an individual. The apartment can either be transferred from the municipality directly to the individual, or it can be transferred to a housing cooperative, which will subsequently be transformed into a unit owners’ association.

A similar change is proposed for corporate taxpayers.

Amendment to the VAT Act

The amendment to the VAT Act, under which the limit for registration as a taxpayer should be increased from 1 January 2023 (from the current CZK 1 million to CZK 2 million for twelve consecutive months), is still in the middle of the legislative process. In addition to the actual increase in the limit, the amendment also contains rules for the transition between 2022 and 2023, and even allows some persons who exceed the limit of CZK 1 million this year to avoid becoming VAT payers.

In certain situations, the amendment should also extend the deadlines for submitting VAT control statements and reduce the existing penalties for their late submission.

The submitted amendments concerning the change in the tax rate for the supply of fruit, vegetables and sweetened beverages were eventually withdrawn and the amendment no longer regulates VAT rates. As of the editorial deadline, the amendment was approved by the Chamber of Deputies and referred for further discussion at the next Senate meeting.

The amendment to the Income Tax Act brings a number of innovations in the area of corporate taxation. We have summarised all the essential information in this article.