Tax Consolidation package: proposed changes to passenger car depreciation

The draft Consolidation Package, which concerned the setting of depreciation limits for M1 passenger vehicles, has been amended following a comment procedure to give the proposal a more concrete outline. As the amendment is now in the Chamber of Deputies, we provide you with an overview of the specific changes and possible impacts.

The consolidation package in the context of passenger cars

In our initial introduction to the contents of the consolidation package, we informed you about the intention to limit the depreciation of M1 passenger cars for income tax purposes to CZK 2 million. After an external comment procedure, the law was loaded into the Chamber of Deputies and several changes were made in this area. Among other things, the limit for claiming the value added tax deduction is proposed to be CZK 420,000 for M1 passenger vehicles. In the further text, we would like to introduce you to the key changes.

In the beginning, it is important to recall what is meant by an M1 vehicle for which the depreciation limitation is to occur. The necessary amendment is contained in Regulation (EU) 2018/858 of the European Parliament and of the Council of 30 May 2018 on the approval of motor vehicles and their trailers, according to which it is generally a motor vehicle with a maximum of eight seats in addition to the driver’s seat.

Standard vehicle purchase

The proposed limit for claiming the value added tax deduction for M1 passenger vehicles is based on the corresponding input price of the cars amounting to a maximum of CZK 2 million. With exceptions – for example, in the case of cars used for licensed passenger transport – it will only be possible to claim 21% of the amount, i.e. CZK 420,000. After many years, the limitation on the right to deduct tax on passenger cars is thus being reinstated in the VAT Act.

Some of you may also recall that the limitation of depreciation for passenger cars has already been introduced in the Income Tax Act once before as well, around 2004. At that time, however, the input price of the asset was limited. The current legal construction is somewhat different, it is not the input price of the asset that is limited, but the amount of depreciation that can be claimed. Thus, the taxpayer will calculate depreciation on the selected car in a standard manner but will only apply to tax deductible costs the part of the depreciation that corresponds to the ratio of the CZK 2 million limit to the input price of the asset.

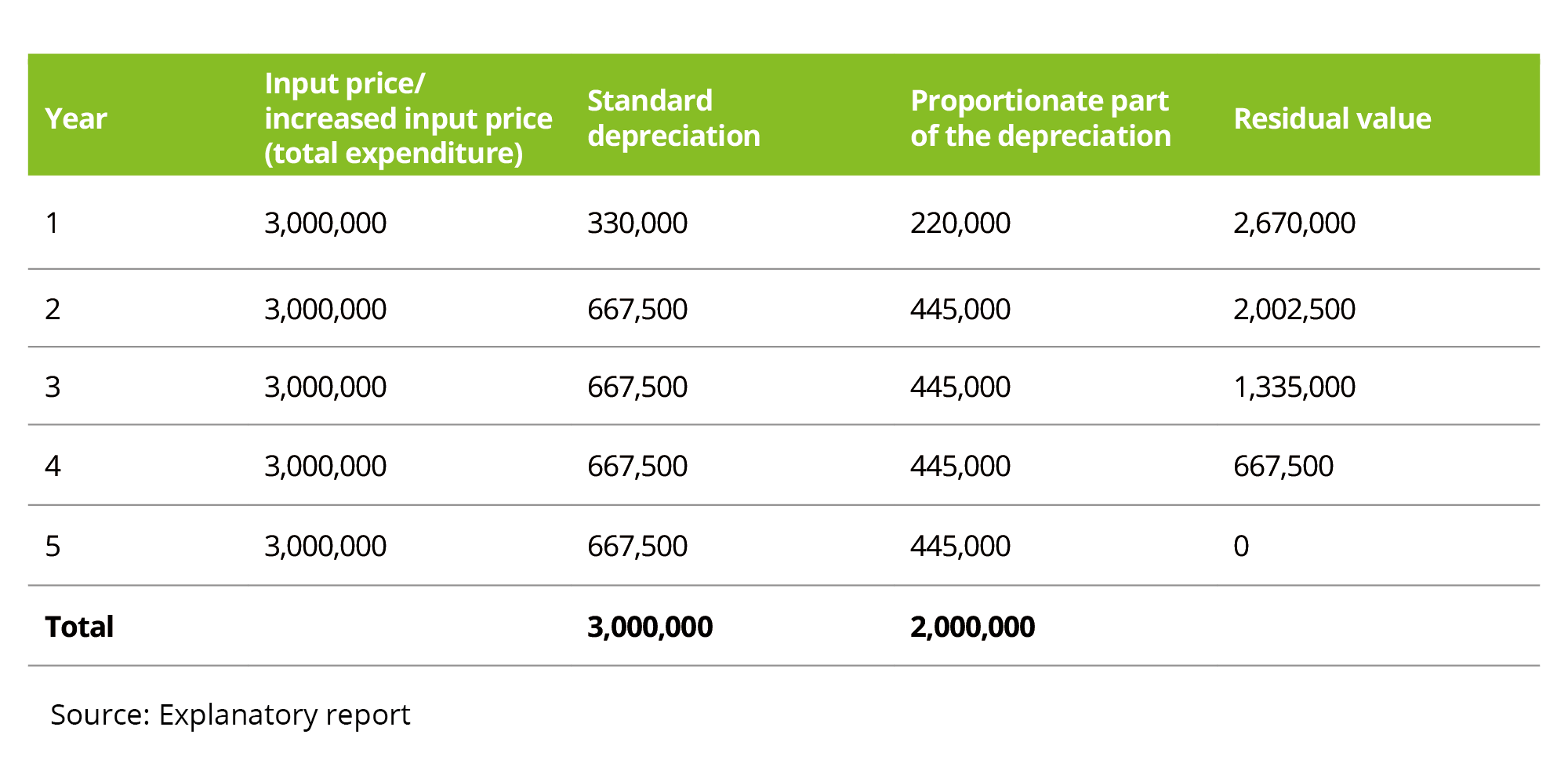

The procedure can best be seen in the example given in the explanatory report to the amendment. An entity acquires a vehicle for CZK 3 million. The depreciation reduction ratio is then determined as 2,000,000/3,000,000 = 2/3.

Straight-line depreciation:

Special rules are then laid down for technical appreciation or other changes in the input price or residual value of such limited assets. Simply put, after each change in the input or residual value, the above ratio will have to be recalculated in order to apply depreciation correctly.

An interesting situation then arises when a taxpayer sells a vehicle with a limit on the expenses and tax deductions that can be claimed. The sale of the car itself and the principal taxability of such transaction are not specifically regulated and are therefore treated in the standard way. However, the residual value that the taxpayer can claim in the tax base is constructed in a different way, namely that it is always calculated as if the vehicle had been depreciated without interruption, over a minimum depreciation period, regardless of the limited expenses. However, the method of depreciation (straight-line, accelerated or extraordinary depreciation) is, with exceptions, at the taxpayer’s discretion.

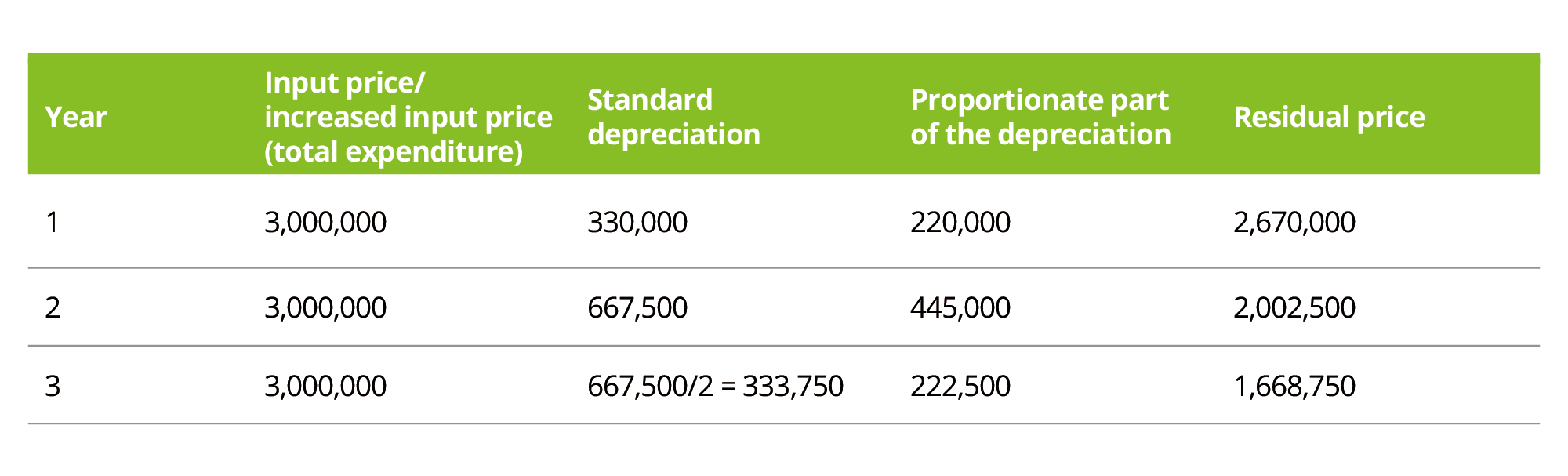

Therefore, if we follow the previous example and the company sold the above-mentioned vehicle in the third year of depreciation for CZK 1.8 million, the tax treatment would be as follows:

The tax base will include the gain on the sale of CZK 1,800,000 – CZK 1,668,750 = CZK 131,250. The entire sale price will be subject to value added tax.

Finance leases

Similar treatment as for the purchase applies to the acquisition of an M1 car by way of a finance lease. Here too, the limit of CZK 420,000 in the right to deduct value added tax and the tax-deductible expense limit will apply.

When acquiring a vehicle under a finance lease contract, the expenses are applied on a pro rata basis as well, but this time we apply the aggregate of the expenses arising from the lease agreement to the CZK 2 million limit. This is only for a simple starting situation, otherwise any technical improvements or other similar amounts must be added to the total payments under the contract. The limit of CZK 2 million for a particular vehicle is then carried over for the subsequent purchase of such assets. For any tax depreciation of a vehicle acquired after the end of the lease agreement, the CZK 2 million limit must be reduced by the amounts already claimed under the finance lease payments so that the taxpayer claims only CZK 2 million in total as tax deductible expenses. However, the limit on tax deductible expenses applies only to users of finance leases. A leasing company providing a vehicle with limited expenses is therefore not subject to the rule, regardless of to whom it provides the vehicle.

Operating leases

However, the law provides for the opposite approach in the case of an operating lease. Here, the amount of the value added tax deduction and the amount of tax-deductible expenses will not be limited for the lessee and any limitations will fall on the lessor. Therefore, the lessor (leasing company) will limit the amount of tax deduction and the amount of depreciation applicable to an M1 vehicle with an acquisition cost exceeding CZK 2 million. The lessee will then be able to claim the tax deduction and take the vehicle rental into account as an expense without limitation, provided of course that it meets the other conditions of the Value Added Tax Act and the Income Tax Act.

In conclusion, the regulation on the limitation of the right to deduct VAT and tax-deductible expenses for M1 vehicles is quite robust and extremely complex. It is also important to note that the acquisition price of electric vehicles is still relatively high and therefore the application of this newly proposed system may not be exceptional in the future and may not target only luxurious vehicles. This raises the question of whether the Government’s promises to simplify the tax system in the Czech Republic and to support electromobility are being fulfilled. The law has just entered the legislative process and will face a detailed political debate, which we will follow and keep you informed of its development.