Accounting

Fees in accounting: estimated payables or reserves?

With the end of the financial year, many companies are faced with the need to recognise unpaid management or employee bonuses in their accounts. Each year we see different views on how to handle this in the financial statements. The eternal battle of “estimate versus reserve” does not always have a clear winner, and it may be that your company had changed its perspective, for example, when it changed auditors or CFOs. In this article, we will take a closer look at the arguments behind the decision “for a reserve” and “for an estimate”.

Reserve

Reserves are recognised for future expenses that will be necessary to settle a present liability recognised as an expense in the current period in which the liability arises. By the nature of accounting for a reserve as a liability (credit) and an expense (debit), it can be clearly stated that the liability already exists (in the current period) at the time the reserve is recognised. Thus, both the liability and the expense are present; only the expense is future and uncertain and therefore needs to be estimated in a qualified manner. In addition to the accrual basis, reserves also reflect the application of the prudence concept as embodied in the current Accounting Act in Sections 25(3) and 26(3).

Expenses related to the creation of a reserve, unless it is a “statutory reserve” regulated by the Reserves Act (593/1992 Coll.), are non-tax-deductible expenses.

Estimated payables

The entity uses estimated payables to apply the accrual principle. From an accounting point of view, estimates (also) represent existing liabilities for which the entity does not have the necessary documents at the date of the financial statements, i.a. to determine their exact amount. Czech Accounting Standard 017 states that estimated payables represent liabilities that cannot be accounted for as a normal debt, such as unbilled supplies. Supplies can be thought of as various types of unbilled services and purchases that the company has made but has not received the related invoices or bills by the time the books are closed – for example, electricity was consumed during the financial year, but the supplier has not yet billed for the consumption.

In the case of estimated payables, the counterpart will typically be one of the expense accounts and these expenses are usually included in the tax base – these are tax-deductible expenses. However, not always. For the sake of completeness, let us add that estimated payables may have their counterpart in another balance sheet item (e.g. unbilled supplies of fixed assets under the Czech Accounting Standard 013) or as a deduction from income (estimates for customer bonuses, etc.).

This feature also reflects one crucial difference between reserves and estimated payables: while estimated payables track an expense or income type (or are recognised against another balance sheet item), a reserve is always part of a set of all operating or financial reserves – with the exception of the corporate income tax reserve. The set of such reserves in the relevant income statement line may contain various items – whether responding to legal risks, litigation, customer business cases, containing sales bonuses to customers, responding to supplier business cases, remuneration components including outstanding vacation days, etc.

In practice, this characteristic of the presentation of reserves is often used as a last resort to recognise in the accounts a (typically negative) circumstance for which our current accounting legislation has no other defined solution. With the definition of the components of financial statements under the new accounting legislation, promised by the Accounting Act currently undergoing the comment procedure, accounting practice will take a significant step forward.

Tax deductibility should not be the determining factor

As discussed above, the different approach to the tax-deductibility of estimates and reserves has a negative impact on the choice/use of the title. However, the tax deductibility aspect must not be a criterion for deciding whether the accounting facts are correct, as this directly contradicts the principle of a true and fair view.

How to decide?

The substance of the facts themselves is essential when deciding whether to categorise them under an estimate or reserve. It is recommended to follow a few simple rules:

- estimated payables:

- we know the period to which the estimate belongs and when the settlement will occur

- certainty that a liability exists (existing debts)

- we do not know the exact amount

- reserves:

- we know the period to which the reserve belongs, but we do not know when the settlement will occur

- other uncertainty / other risks (i.e. facts that are certain to occur in the future but it is not known exactly when they will occur; or are only likely to occur in the future but not certain)

- we do not know the exact amount

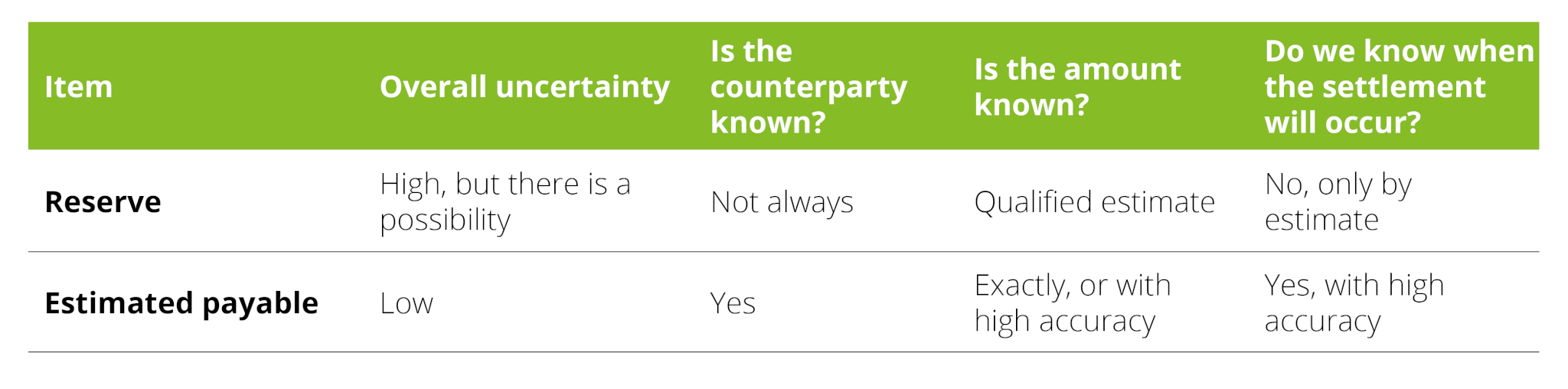

The table below also provides an overview and other possible criteria to consider.

Bonuses and fees – estimate or reserve?

As already mentioned, in practice, reserves are confused with estimated payables (or vice versa), especially under the pressure of taxes.

However, the post-2010 case law in this area states that the most important thing is to carefully assess the agreed terms of remuneration, the conditions for the award of remuneration or a bonus, and its dependence on the decision of the company’s management (or a supervisor).

The court further holds that it is essential whether the benefit constitutes a wage claim that the employer is obliged to grant if the employee fulfils the agreed requirements and conditions. If the entitlement arises only on the basis of an independent decision by the employer to grant it, it is a so-called variable wage component which cannot be accounted for by means of an estimate (thus reducing the tax base…).

A bonus is a component of remuneration that depends on the fulfilment of objective conditions. These must be specific, objectively measurable and quantified – the actual determination of the amount of this remuneration is the subject of a calculation for which inputs exist at the end of the period (e.g. economic results, number of complaints, etc.). In these cases, despite the fact that the payment of the remuneration needs to be formally granted by the company body/manager, which only occurs in the period following the end of the relevant period, it is still a fixed wage component and the subsequent decision to grant it is merely a formal confirmation.

The fact that the entitlement to its payment did not arise until the following year, e.g. after the completion of an accounting audit, is a matter that does not affect the question of the appropriateness of accounting for the liability in the form of an estimated payable.

If the final decision to grant a bonus is made (in the form of an evaluation of performance based on management/supervisor discretion) after the year’s end, an estimated payable cannot be recognised at the balance sheet date because the employee’s legal entitlement to the bonus or remuneration did not exist at that time. A reserve would be more appropriate (we know there will be a settlement, but we do not know for sure what the supervisor’s decision will be).

The above-mentioned court judgements imply that if no undisputed entitlement to remuneration has arisen, it cannot be accounted for as an estimated payable but only as an accounting reserve.

It is no secret that in practice, a combined approach is often used – an estimated payable is used because, unlike a reserve, it follows an expense type (i.e. it is charged to account group 52) but is treated as a non-tax deductible expense for tax purposes (and therefore constitutes the basis for deferred tax).

Conclusion

Finally, it is essential to note that the issue of estimated payables and reserves is not clearly regulated by the legislator for users and authors of financial statements. From an accounting point of view, it is necessary to note that in both cases, it is a liability. It is important to be able to justify and understand the reason for the selection of the appropriate line for recognition in the financial statements. If it is significant, it should be described in the notes to the financial statements so that users of the financial statements can understand it.

From a tax perspective, it is vital to take into account situations where there is a change of perspective after a number of years and to consider with tax advisers whether there may have been an unjustified income tax avoidance. A consistent approach in otherwise identical circumstances is also critical here.

Sources:

[1] Mejzlík J., Podstata rezerv a chyby při jejich vykazování [The Nature of Reserves and Errors in their Recognition], Časopis Auditor KAČR [The Chamber of Auditors of the Czech Republic, The Auditor Magazine], no. 4/2020

[2] Judgment ref. no. 8 Afs 35/2010-106 dated 31 March 2011

[3] Judgment ref. no. 7 Afs 16/2012 dated 7 June 2012

[4] Judgment ref. no. 8 Afs 1/2012-58 dated 29 June 2012