IASB issued new standard IFRS 18

On 9 April 2024, the International Accounting Standards Board (IASB) published its new standard IFRS 18 Presentation and Disclosures in Financial Statements that will replace IAS 1 Presentation of Financial Sta…

New standardised INCOTERMS® 2020, issued by the International Chamber of Commerce in September 2019, became effective on 1 January 2020. Compared to the 2010 version, INCOTERMS® 2020 are clearer and offer more exact definitions of obligations and responsibilities.

In our article, we will first summarise the history and structure of INCOTERMS® and then have a look at what changes have been brought by the new version, INCOTERMS® 2020. Finally, we will use examples to demonstrate the application of certain INCOTERMS® rules and their impact on the accounting of a business.

INCOTERMS® rules or International Commercial Terms are a set of international rules for the interpretation of business clauses most frequently used in international and domestic business. They have been issued by the International Chamber of Commerce (ICC), who is the owner of a registered trademark of INCOTERMS®, since 1936 with the aim of eliminating issues related to differences between the commercial codes of various countries. The sixth version of these rules – INCOTERMS® 2020 – has been effective since 1 January 2020.

The INCOTERMS® rules explain a set of eleven of the most commonly-used three-letter trade terms in contracts for the sale and purchase goods. The INCOTERMS® rules describe:

- The distribution of obligations between the seller and the buyer (arranging transportation, insurance of goods, procuring transport documents and import or export licence);

- When risk is transferred from the buyer to the seller; and

- Which party is responsible for which costs.

INCOTERMS® 2020 do not specify the goods sold, do not address matters regarding the transfer of the ownership title, the claim to the goods or the payment of the purchase price. They do not replace a purchase agreement, they merely become its component if they are explicitly included in an existing agreement.

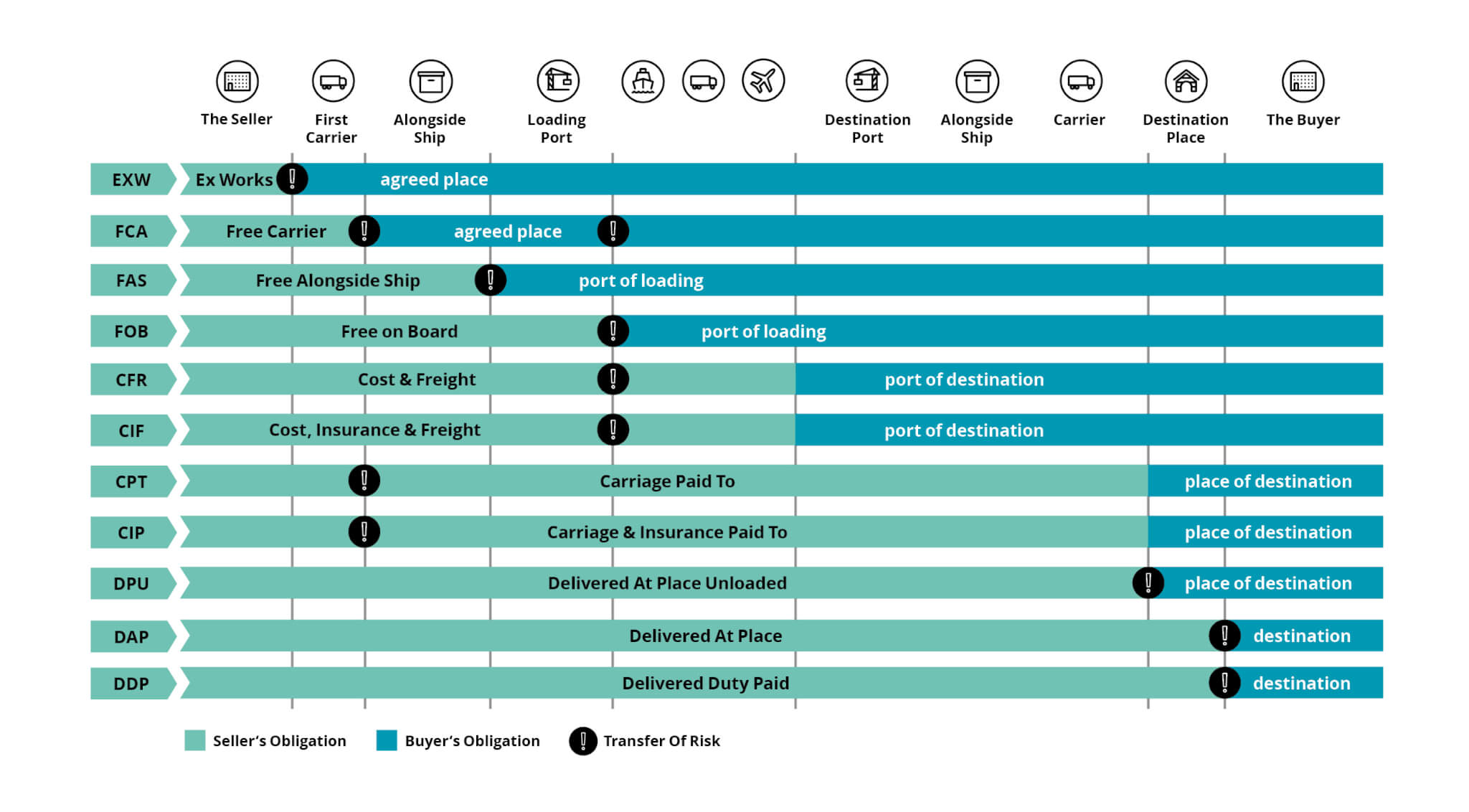

Like the previous version, INCOTERMS® 2020 include a total of 11 rules divided into 2 groups:

1. Rules suitable for all method of transport – include 7 INCOTERMS® 2020 rules which may be used regardless of the method of transport and regardless of whether one or more types of transportation are used:

2. Rules applicable only to sales that solely involve sea and inland waterway transport – include 4 INCOTERMS® 2020 rules:

INCOTERMS® rules have traditionally been applied to international trade, which involves the cross-border transport of goods. In various parts of the world, in particular trade blocks such as the European Union, crossing borders has become much less significant. That is why these rules are more and more often applied not only to international, but also to in-country purchase contracts.

The below graph clearly illustrates the difference between the individual rules:

The objective of the revision of INCOTERMS® was to improve the presentation of rules to make the selection of the most suitable rule for the relevant purchase agreement as simple as possible. The new organisation of the individual articles of the rules will better reflect the logic of a business transaction.

INCOTERMS® 2020 bring the following important changes:

- The abbreviation of the older rule DAT (Delivered at Terminal) changes to DPU (Delivered at Place Unloaded) – the destination may be any place and not just a “terminal”.

- In the event of sale of goods using the FCA rule with a subsequent sea voyage, an additional provision has been added, specifying that the Bills of Lading may be provided only after lading.

- The CIF and CIP terms no longer have the same scope of minimum insurance coverage, but the parties may agree on a different coverage.

- It is now possible to arrange transportation using the seller or buyer’s own funds in relation to FCA, DAP, DPU and DDP.

- Security requirements have been included in transportation obligations and costs.

- The individual rules now include more detailed explanations clarifying the basic features of each INCOTERMS® 2020 rule.

We recommend reading the new INCOTERMS® 2020 closely, especially to importers and exporters. Please note that all older versions of INCOTERMS® remain effective.

An entity may use INCOTERMS® as input terms (ie namely with regard to the purchase of material) and output terms (ie when selling its own products). We will primarily focus on the sale of products and additionally, we will provide an analogous description of principles for purchases of material. It is obvious that a sale or income for one entity is another entity’s purchase or input. Therefore, the principles relating to the recognition of one entity’s income should correspond, to a certain degree, with the recognition of another entity’s purchase.

Example 1

A Czech company manufacturing electronic equipment provides deliveries to its customer located abroad using the CPT term. The shipment is loaded on a truck at the company’s registered office in the Czech Republic on 31 December 2019 and is transported to the airport; from there the shipment is transported by air abroad. Since the customer’s registered office is located near a regional airport, the total time for delivering the products to the customer does not exceed two days. The question is: How will the income be recognised at 31 December 2019, ie the balance sheet date?

Solution:

In brief, the CPT delivery term means that the transportation is ensured by the Czech company which bears all costs related to the transportation. However, the risks related to the delivery cease to be borne by the Czech company as soon as the shipment is passed to the carrier (the first carrier in the event that more than one carrier is involved). The day of delivery and therefore the day of transaction is the day when the goods were handed over to the carrier.

On the basis of the document confirmed by the carrier, the Czech company may recognise income arising from the sale of products (components). The practical implementation means that, if the Czech company delivers its products to the carrier on 31 December 2019, the company can recognise income on this date, even if the shipment reaches the customer located abroad later, for example on 1 January 2020. At the same date the Czech company will recognise the dispatch of finished products (related cost on account No. 58x – Change in the Inventory of Goods).

Example 2

A Czech company that manufactures automotive components has contracted supplies to a customer located in China using the DAP delivery term. At the company’s registered office in the Czech Republic, a shipment comprising the components is loaded onto a truck and transported to Hamburg from where it is transported by ship to an agreed Chinese port; there the shipment is received by the Chinese customer (the customs clearing is provided by the Chinese customer). The question is: How will the income arising from the shipments dispatched during December 2019 be reported as of 31 December 2019, ie the balance sheet date?

Solution:

In brief, the DAP delivery term means that the supplying company covers the transportation and additional costs (such as insurance and various fees) until the moment the goods are placed at the disposal of the buyer on the arriving means of transport ready for unloading at the named place of destination., ie the supplying company bears the risk of impairment of goods until this moment; conversely, the customer provides for the clearance of goods in his country, bearing the costs and the related risk.

The Czech company still owns the goods, bears the risk related to the shipment until it is received by the customer in the Chinese port, ie in the event that there is an accident during the voyage, the shipment is stolen, etc, the respective damage is incurred and the relevant costs are borne by the Czech company (generally companies take out appropriate insurance). The income from the sale of products will be recognised by the Czech company only when the delivery of goods occurs, i.e. when the shipment is received by the customer in the Chinese port, based on the confirmed delivery note or other document. The income arising from the shipments (dispatched during December 2015) will be recognised in January 2020.

As a result, the Czech company shall not recognise the dispatch of the products out of stock (eg Dr: account no. 58x – Change in finished products, Cr: account no. 123 – Products in stock), as the finished products are still owned and held by the Czech company. However, with regard to the degree of risk, the shipped products comprise a different category of inventory than the products held in the company’s stock in the Czech Republic. Therefore, it is advisable that the company report the shipped finished products on a separate sub-ledger account, eg sub-ledger account no. 123 – Finished products in transit, to be received by customers (ie, this would only involve the reclassification within the accounts of the inventory of finished products).

In practical usage, the invoice relating to shipments similar to the one named in our example is often issued and dispatched along with the shipment of goods; often the invoice accompanies the goods during the transportation. The question is how the invoice should be accounted for in the entity’s books. If it is necessary to issue the invoice at the time when goods are dispatched, regardless of what reasons, it is necessary to recognise the invoice on an accruals basis, eg using account no. 384 – Deferred income. Before the actual income is recognised, the issued invoice may be matched with a received prepayment. In practical usage, this treatment of accounting for issued but accrued invoices may give rise to complications in the process of reconciling mutual receivables and payables. Special attention should be given to reconciling intra-group sales or purchases for consolidation purposes.

Example 3

A Czech company purchases spare parts for its production lines from a supplier based in Japan. The supplies are realised on a combined basis, by ship and by truck via the port in Hamburg, using the EXW delivery term. The invoices issued by the Japanese supplier are received in electronic form on the day when the shipment is loaded on board the ship and identical stamped invoices in hard-copy form are received along with the goods. The question is how the purchase of the spare parts will be accounted for with 31 December 2014 as the balance sheet date and 27 December 2019 as the date of initiating the delivery in Japan.

Solution:

In brief, the EXW delivery term means that the customer ensures the transportation himself and assumes the risks related to the shipment upon receiving the shipment at the premises of the manufacturer.

The Czech company arranges a carrier who receives the goods from the inventory of the Japanese supplier. As of that moment the goods are delivered, the company owns the goods, bears the risk related to the delivery (the carrier’s liability for poor loading, accidents etc. is of course not excluded). Under Czech Accounting Standards, the spare parts which are the subject of the supply are usually reported on inventory accounts pending their actual use.

At the date of shipping the goods, the Czech company has the invoice on hand, ie the transaction will be accounted for as inventory in transit against a corresponding entry to payables. The explanation of this accounting treatment is simple: through loading the spare parts by the contracted carrier, the Czech company assumes the liability to pay for these goods to the Japanese supplier, which is an undeniable fact. At the same time, the goods are a guarantee for future benefits (either in the form of the spare parts themselves or in the form of compensation provided by the carrier if the shipment does not arrive as agreed). The category of inventory in transit itself expresses the difference between the degree of risk related to the inventory owned and shipped from the risk related to inventory held by the company that is physically present in the company’s warehouse in the Czech Republic.

Conclusion

The application of INCOTERMS® reflects a different degree of risk related to business transactions. Individual terms define the moment of transferring the risk between the supplier and the purchaser.

Rather than bringing a major revolution, INCOTERMS® 2020 react to the changing needs of the supplier-customer chains.

The above-outlined examples show that the implementation of INCOTERMS® may have significant impacts on the method of presentation of business transactions including an impact on profit or loss. Therefore, it is necessary that appropriate attention be given to INCOTERMS® when applied in practical usage.

However, the customs, tax and other regulations must also be kept in mind.

We note that INCOTERMS® may not be considered individually, but within the context of the relevant commercial contract under which a delivery is arranged. In such an individual case, INCOTERMS® may only provide a supporting definition for the transfer of rights and risks.

Sources: Publication of ICC – INCOTERMS® 2020, Publication of Deloitte – Global Trade Advisory Alert from October 2019

Seminars, webcasts, business breakfasts and other events organized by Deloitte.