Deloitte Live SFTR – the last puzzle to complete the securities reporting requirements (beyond MIFID II, MIFIR and EMIR)

In response to the 2008 financial crisis, (not only) European regulators came up with numerous efforts to reduce financial stability risks arising from shadow banking activities, with the ultimate goal of increasing transparency on the markets and towards customers.

Apart from the rules incorporated in MIFID II, MIFIR and related acts, the Financial Stability Board (“FSB”) came up with new principles covering securities financing transactions (“SFTs”), the Securities Financing Transactions Regulation (“SFTR” or “Regulation”).

The two main components of the SFTR are a transaction reporting requirement and a transparency obligation towards investors on the reuse of collateral. Since there is still no overview of the SFTs market easily available, new rules should bring the detailed picture to regulators and traceability of securities re-use. As an ultimate goal, the SFTR will allow European authorities to monitor systemic risks and shed light on existing market practices.

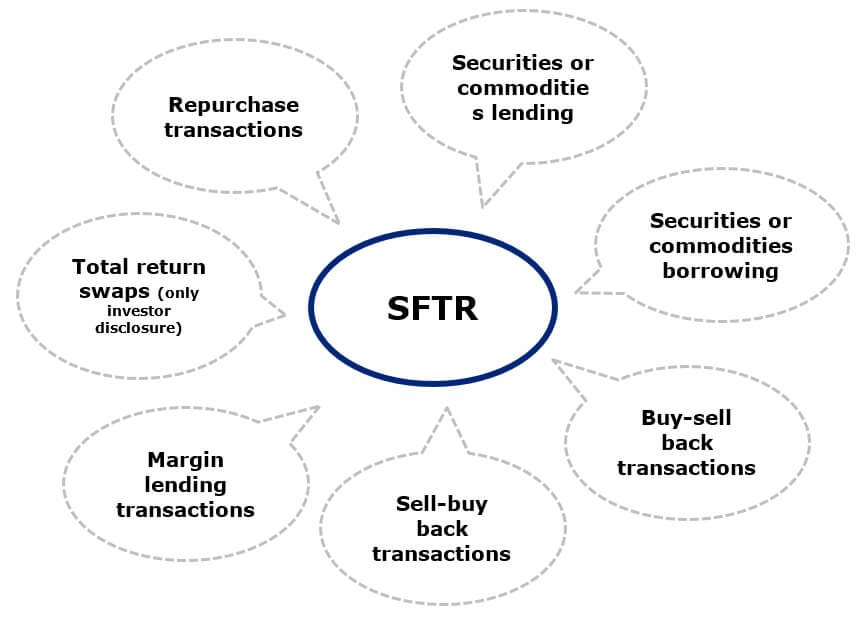

What is in scope?

In the Regulation, the SFTs definition covers repurchase agreements (repos) and reverse repurchase agreements, securities or commodities lending and borrowing transactions, buy-sell backs and sell-buy backs, and margin lending and borrowing. All these can be broadly described as the temporary exchange of cash or securities against collateral. For these, there are 155 fields to be reported, covering various transaction attributes, collateral details, as well as participating parties identification. All the reports have to be declared to an EU approved trade repository; and this is in addition to any previous requirement under the EMIR and the MiFID.

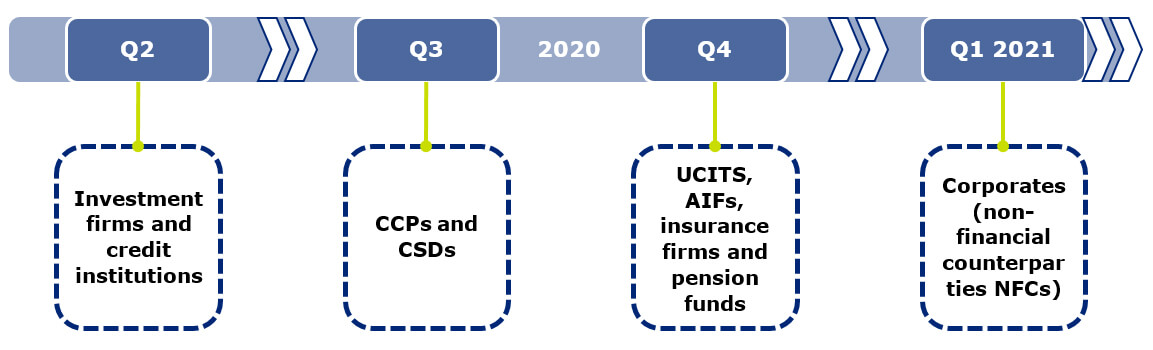

Who will be impacted?

With the recent publication of the technical standards in the Official Journal of the European Union, the final deadline for the Securities Financing Transactions (sFTR) is set; the reporting obligation is to start on 11th of April 2020. The requirements hit banks and MIFID II financial institutions first, followed by CCPs and CSDs expectedly starting their reporting in July 2020, UCITS and Alternative Investment Fund Managers (AIFMs) as well as insurance companies in October 2020 and finally non-financial counterparties in January 2021.

How to get ready?

The reporting requirements of the SFTR are the most extensive in the recent era to be imposed on the financial markets participants. Compliance will require important system upgrades, major data collection and a re-examination of relationships with counterparties. Firms have to report not only a significant volume of static market data, stressing its quality, but also complex data resulting from the growth in ‘collateral optimisation’. A lot of data will not be available in-house and will have to be sourced externally; requiring broader market coordination.

In order to achieve SFTR compliance, it is necessary to review SFTs booking practices, prepare efficient reporting processes and strong exception management. The trade repositories are required to highlight mismatches and report these back to firms which will then need to make the corrections via their exception management process.

If not already tackled, now is the critical deadline to start SFTR budgeting, hiring, planning, building and thinking about testing, controls and governance.

It is always advantageous to take a strategic approach to address the SFTR requirements, rather than viewing them as a compliance exercise. Consequently, this exercise will result in a lower rate of trade fails and greater collateral efficiencies, which can result in a positive balance sheet optimisation.