The technological evolution of recent years has caused companies to shift away from proprietary software and on-premises servers to licensing and cloud solutions. This development has significantly affected the way in which entities should report information on acquired or leased software and licences. Is it an asset or a service? And how to properly report the ancillary costs associated with implementation and operation? Find out all about this topic in our article.

An asset or a service?

According to Regulation 500/2002, intangible fixed assets comprise software that is either developed internally for trading purposes or acquired from other entities. However, the NAC (National Accounting Council) Interpretation I-40 specifies that ‘internal development for trading purposes’ means that the actual development will not only lead directly to the creation of the asset to be traded, but also to the development of the software through which the entity conducts its business. Although this definition is not completely exhaustive, in most cases it can be assumed that a leased licence does not meet the definition of software because it is neither acquired nor internally developed. Lease expenses are typically charged to service expense accounts and are accrued.

Apart from the above, the Czech accounting regulations do not contain any detailed definition of software, intangible assets or assets as such. In this respect, we can hope for an improvement in the form of the new Accounting Act. This is likely to bring changes in the accounting for leases, which will also affect the accounting for leased licences and their potential recognition as an asset.

If we look to International Accounting Standards (IFRS) for inspiration, then even there a leased licence does not always meet the definition of an asset or the definition of a lease. This is because with a leased licence, the customer is only granted the right to access the application or software, and thus does not control the source code as such. As a result, the entity does typically not generate ‘intellectual property’ and should not recognise an intangible asset but only a service cost.

Apart from the licence lease costs, however, customers usually incur relatively significant costs related to configuration, implementation, or operation of the leased system. Particularly in the initial stages of software implementation, these costs may exceed the regular lease payments by several times and their different reporting may have an impact not only on the profit or loss but also on the tax base.

Implementation costs

The key question is whether to capitalise the implementation costs as intangible assets and later amortise them as expenses or to charge them as a service cost with appropriate accruals.

In this respect, the Czech regulations offer even less support than in the case of a leased licence. Without a clear definition of an asset, it is not possible to determine from the Czech accounting legislation whether costs can be capitalised and amortised. The Income Taxes Act, which eliminated the category of intangible assets as of 1 January 2021 and applies acquisition-related expenses at the level of accounting amortisation over the useful life of the intangible asset, also does not provide much help.

It is therefore advisable to base the accounting solution on the ‘true and fair view’ principle and try to find inspiration in IFRS. The IFRS Interpretations Committee issued an agenda decision in April 2021 that addresses how a customer should recognise the costs of configuring or implementing software under a licence.

Similar to the licence itself, it is necessary to determine whether the configuration and implementation costs meet the definition of an intangible asset. If the customer controls the source code to be implemented and configured, receives all the benefits from it and can prevent others from using it, then the identification as an intangible asset can be considered. However, if the source code remains in the ownership of the licensor or a third party, the costs associated with implementing the software must be recognised in expenses. The question remains whether it should be a one-off charge or an accrual over the licence usage period.

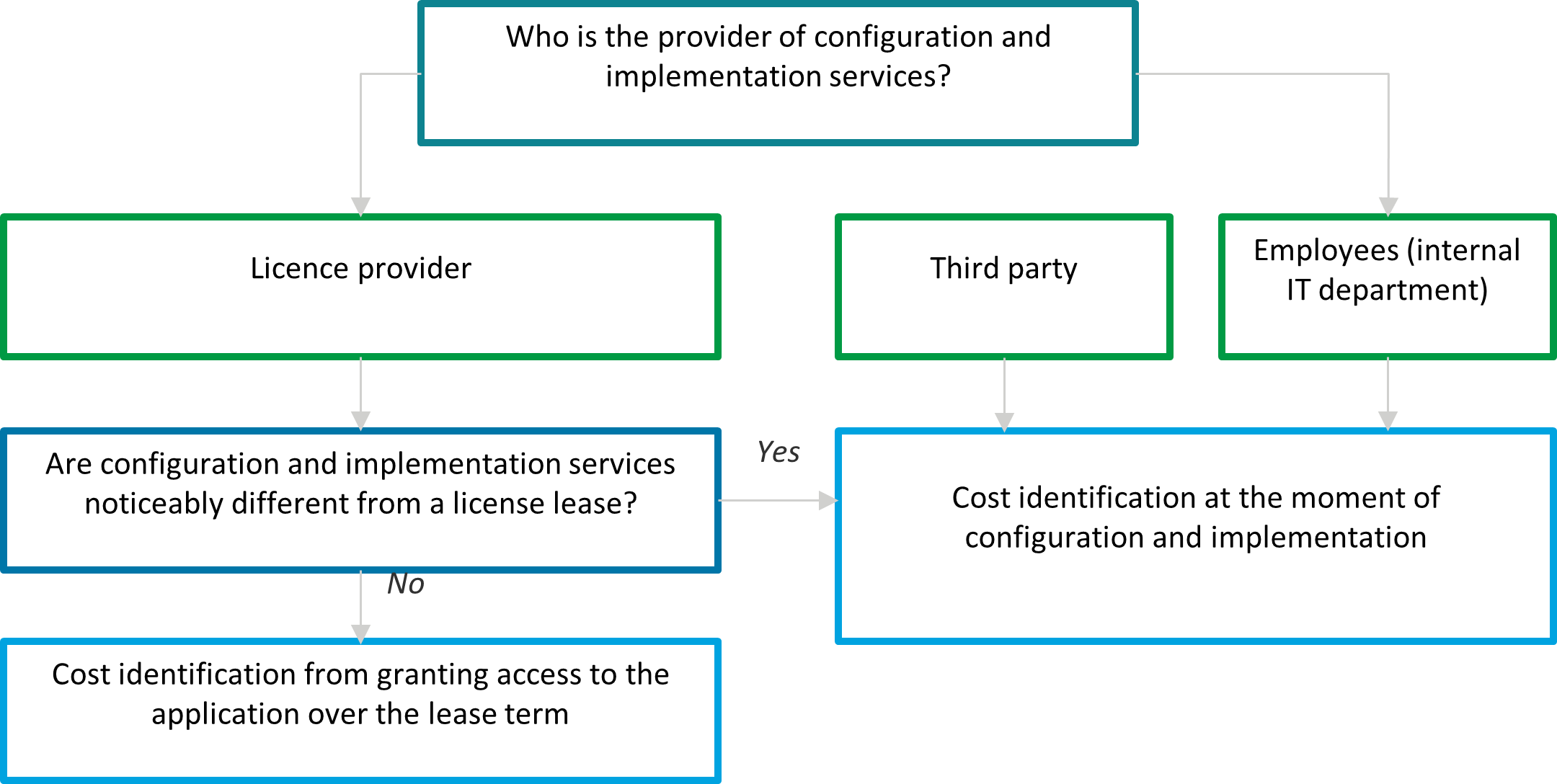

Even when an entity is deciding whether to accrue implementation costs, the IFRS provides some guidance on how to make that decision. This is shown in the diagram below. The main difference is who provides the configuration and implementation services and whether they are distinctly different from the actual provision of the licence.

Examples of an indicator that these are clearly distinct services include the following situations:

- the implementation is or can be carried out by an independent provider; or

- the user can use the licence independently without implementation and configuration services.

Conversely, where

- highly specialised skills are required which are the sole responsibility of the licensor or its contractual partner; and

- the licence cannot be used without configuration and implementation,

these are services related to the licence lease and the costs should be accrued over lease term. For example, for Czech purposes, account 382 – ‘Complex deferred expenses’ can be used, where the costs associated with configuration and implementation are first accumulated and later released from the beginning of access to the system over the lease term.

To conclude, it can be noted that the licence provider does not necessarily have to be a specialised supplier; for example, it can also be a parent company that provides system access to its subsidiaries.