Tax Tax allowances for children will increase. The maximum limit for the payment of a monthly bonus will be abolished

On 27 July 2021, Act No. 285/2021 Coll. was published in the Collection of Laws, amending Act No. 586/1992 Coll., on Income Taxes, as amended, specifically the area of tax allowances for children as defined in Sections 35c and 35d. Both amendments will decrease the tax burden of taxpayers.

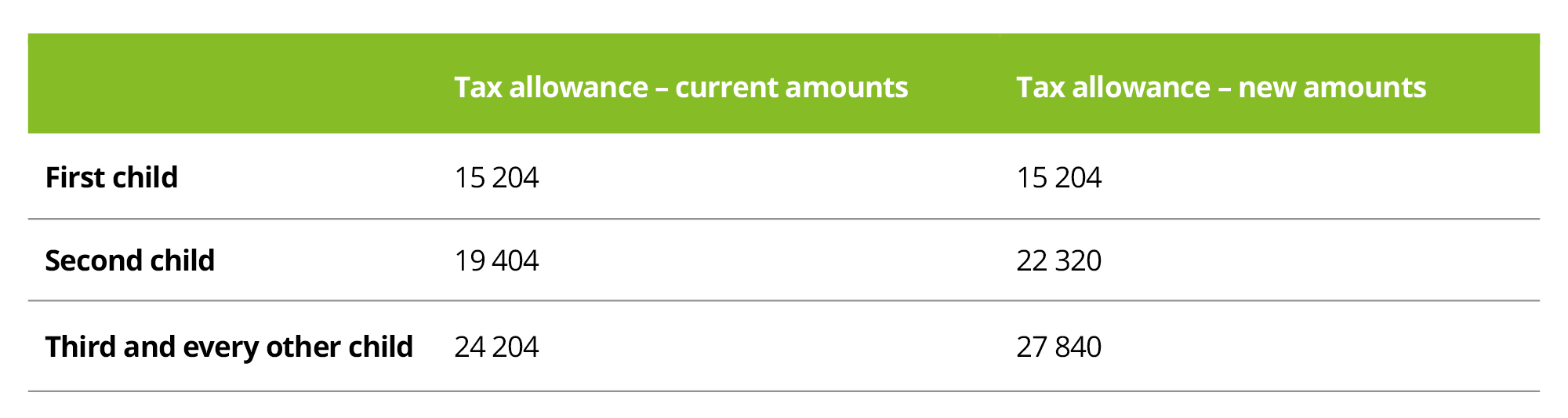

The first amendment pertains to the increase in tax allowance for a second child from CZK 19,404 to CZK 22,320 per year (CZK 1,860 per month) and in the case of a third and subsequent child from CZK 24,204 to CZK 27,840 per year (CZK 2,320 per month). Therefore, in the case of a second child, the taxpayer will newly be able to reduce their tax liability by an extra CZK 243 per month (CZK 2,916 per year), and in the case of a third and every other child by an extra CZK 303 (CZK 3,636 per year). There will be no change in the case of the first child – the tax allowance amount will remain at CZK 15,204 (CZK 1,267 per month).

The table below presents an overview of the current and newly approved tax allowance amounts:

The Income Taxes Act stipulates the increase in tax allowances for children already for the 2021 taxation period. The new amounts will be applied retrospectively after the 2021 taxation period has ended in the following manner:

- in the annual tax reconciliation for 2021, or

- in the personal income tax return for 2021.

Taxpayers who will apply tax allowances for two or more children during the taxation period should therefore make sure to ask their employer to perform the 2021 annual tax reconciliation by 15 February 2022 or to file a personal income tax return within the statutory deadlines.

Abolition of the maximum limit

The second amendment to the Income Taxes Act, specifically Section 35d (4), brings about the abolition of the maximum limit for the payment of a monthly tax bonus for a child in the amount of CZK 5,025. Unlike the increase in tax allowance amounts, the abolition will first apply in the 2022 taxation period when calculating the tax prepayment for January 2022. However, the provision will still apply that a monthly tax bonus can only be paid out when it amounts to CZK 50 or more.