On 6 November 2019, the Chamber of Deputies passed a bill amending selected tax legislation in relation to increasing the public budget income. The amendments concern, inter alia, consumption and gambling taxes. The bill will now be considered by the Senate.

Consumption taxes – significant changes in tax rates

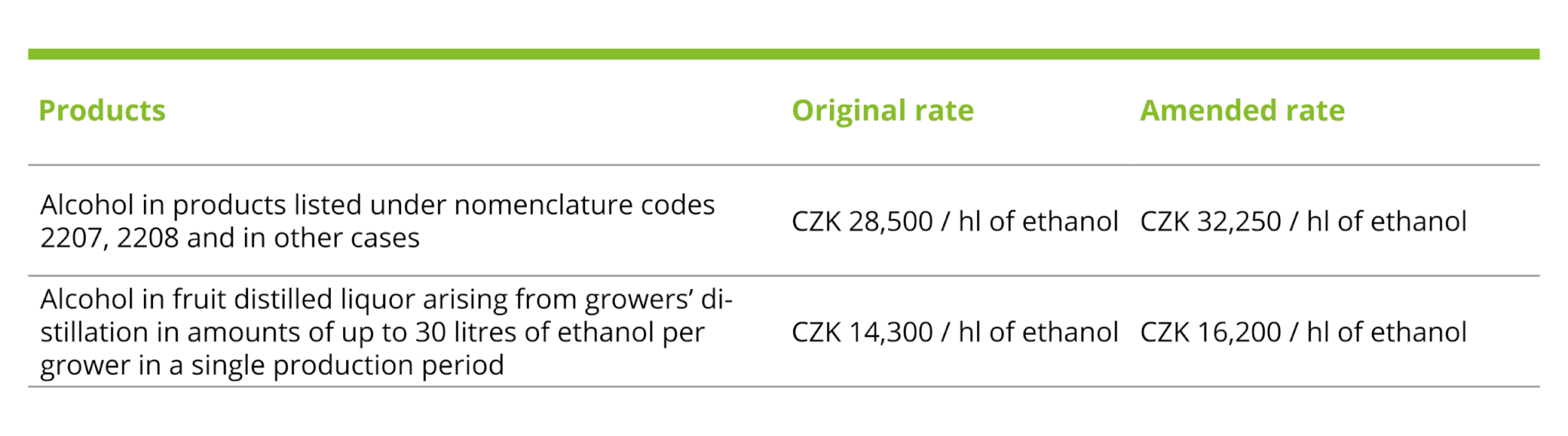

A significant change relates to an increase in alcohol tax rates. The alcohol tax rate in respect of alcohol contained in products under nomenclature code 2207 (such as products containing more than 80% of alcohol or alcohol products used as fuel), nomenclature code 2208 (such as whiskey, vodka, gin) and in other cases will newly be CZK 32,250 / hl of ethanol. Furthermore, the alcohol tax rate will increase to CZK 16,200 / hl of ethanol in respect of alcohol in fruit distilled liquor arising from growers’ distillation in amounts of up to 30 litres of ethanol per grower in a single production period. Changes in tax rates are summarised in the table below.

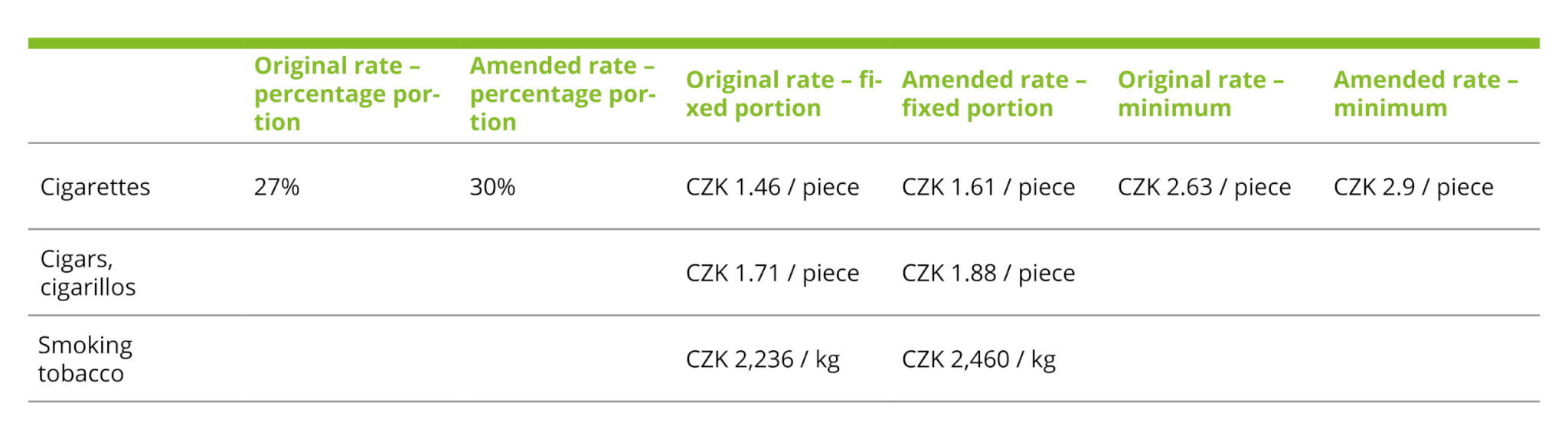

Another increase in tax rates will relate to tax on tobacco products when the percentage portion for cigarettes newly increases to 30%. The fixed portion of the tax rate will newly amount to CZK 1.61 / piece for cigarettes, CZK 1.88 / piece for cigars and cigarillos and CZK 2,460 / kg for smoking tobacco. Furthermore, the minimum tax rate for cigarettes should also increase to the aggregate minimum amount of CZK 2.9 / piece. In respect of heated tobacco products, the tax rate should increase to CZK 2.46 / piece. Changes in tax rates are summarised in the table below.

The passage of this act may result in an obligation to change tax collateralisation arising for tax warehouse operators or authorised recipients in respect of recurrent receipts of selected product. Therefore, it is necessary to calculate an increase in tax collateralisation, if any.

Interestingly, the limit for beer produced by an individual in facilities for home production of beer will increase as well; newly, if the amount of beer produced in this manner does not exceed 2,000 litres on a calendar year and the beer is not sold by the producer, the producer will not be considered a taxpayer.

Gambling tax – change in tax rate

The tax package also includes a change in tax rate in respect of a partial tax base for lottery tax that should newly amount to 35%, rather than 23%. The original wording of the act intended to increase gambling tax rates also for other partial tax bases; however, several amendments have been made to the bill, ruling out other increases in tax rates from the bill.

Further development

At present, the bill will be considered by the Senate. The Senate may pass, reject or return it with amendments to the Chamber of Deputies. If the bill is rejected or amended by the Senate, the Chamber of Deputies will once again take a vote on the bill. Nevertheless, the wording of the act is anticipated to take effect from 1 January 2020.

If you wish to obtain more details from us, please do not hesitate to contact us.