Sustainability Law The Sustainable Finance Disclosure Regulation: New rules for financial service providers

The Sustainable Finance Disclosure Regulation (SFDR) is one of the core actions initiated by the EU’s action plan on financing sustainable growth. As it bears the legal form of regulation it is directly applicable and thus harmonizing the disclosure requirements of sustainability-related information across all material FSI sectors (AIFMD, UCITS, Solvency II, IDD and MiFID II). What kind of disclosure does the regulation require, and who does it apply to in practice?

The SFDR disclosures were rolled out in two phases, often referred to as Level 1 and Level 2, with Level 1 disclosures being effective from March 10th, 2021, and level 2 from January 1st, 2023. SFDR is designed to provide transparency and harmonization to sustainability claims within financial markets; help direct and accelerate the flow of capital towards sustainable and impactful projects and businesses; and help incorporate ESG risks into the risk management practices.

The regulation lays down disclosure obligations for all financial market participants and financial advisors who operate in the EU or market to EU-domiciled clients.

The SFDR specifies:

- Article 6 products: financial products that do not consider ESG or products where it is not relevant to integrate ESG considerations or products that do not fall under article 8 or 9.

- Article 8 products (light green): financial products that promote environment and/or social characteristics

- Article 9 products (dark green): financial products that have sustainable investment as an objective

Entity vs product level

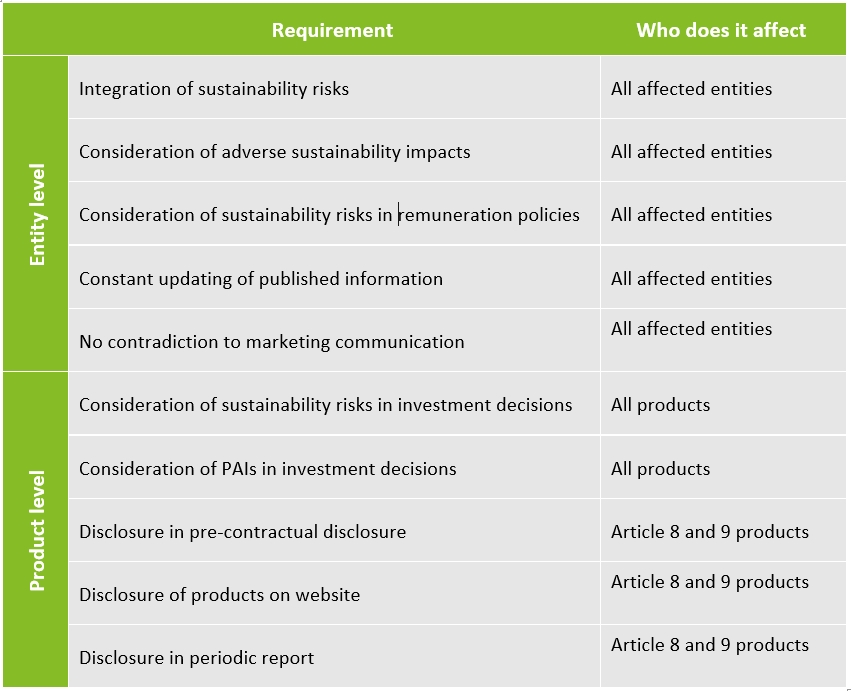

The SFDR disclosures obligations are defined at two levels: entity level and product level. Under the entity level disclosures entities have to, for example, publish information about their policies on integration of sustainability risks. All entity level disclosures are published on the entity’s websites, which must be regularly updated. Under the product level disclosures, entities disclose information specific to a given financial product. Product level disclosures are included in pre-contractual disclosures, periodic reports and on websites.

Great Reclassification

In the last couple of months, we have witnessed a wave of reclassification of financial products. The reclassification wave could be seen as the preparation of asset managers for the updated disclosure regimes that came into effect this year. Based on the recent Morningstar report, 419 funds were reclassified since September 2022, the majority of which were downgraded. The biggest wave of downgrades affected Article 9 funds, where about 300 funds were reclassified to Article 8, representing 175 billion EUR of assets.