Tax

The tax package has brought changes into the field of excise taxes as well

On 1 January 2021, pursuant to Act No. 609/2020 Coll., the tax package that has brought significant changes to tax laws (e.g. with regard to the Income Taxes Act) became effective. Let’s summarise how these changes affect the field of excise taxes.

On the one hand, the Act reduced the excise tax rate on mineral oils, more specifically the tax rate on medium oils and heavy gas oils (diesel). With effect from 1 January 2021, the tax rate decreased from CZK 10,950 per 1,000 litres to CZK 9,950 per 1,000 litres. In this matter, the General Directorate of Customs (GDC) has issued information concerning the procedure for stating the total amount of excise tax on documents substantiating taxation pursuant to Section 5 of the Excise Taxes Act. This could prove unclear in the case of petrol stations, for example, which will gradually release fuel from their tanks taxed at different excise tax rates. The GDC informs that the “total amount of the excise tax” entry stated on the documents pursuant to Section 5 of the Excise Taxes Act must correspond to the product of the quantity of the selected commodity and the tax rate valid at the time of the selected commodity’s release to free tax circulation.

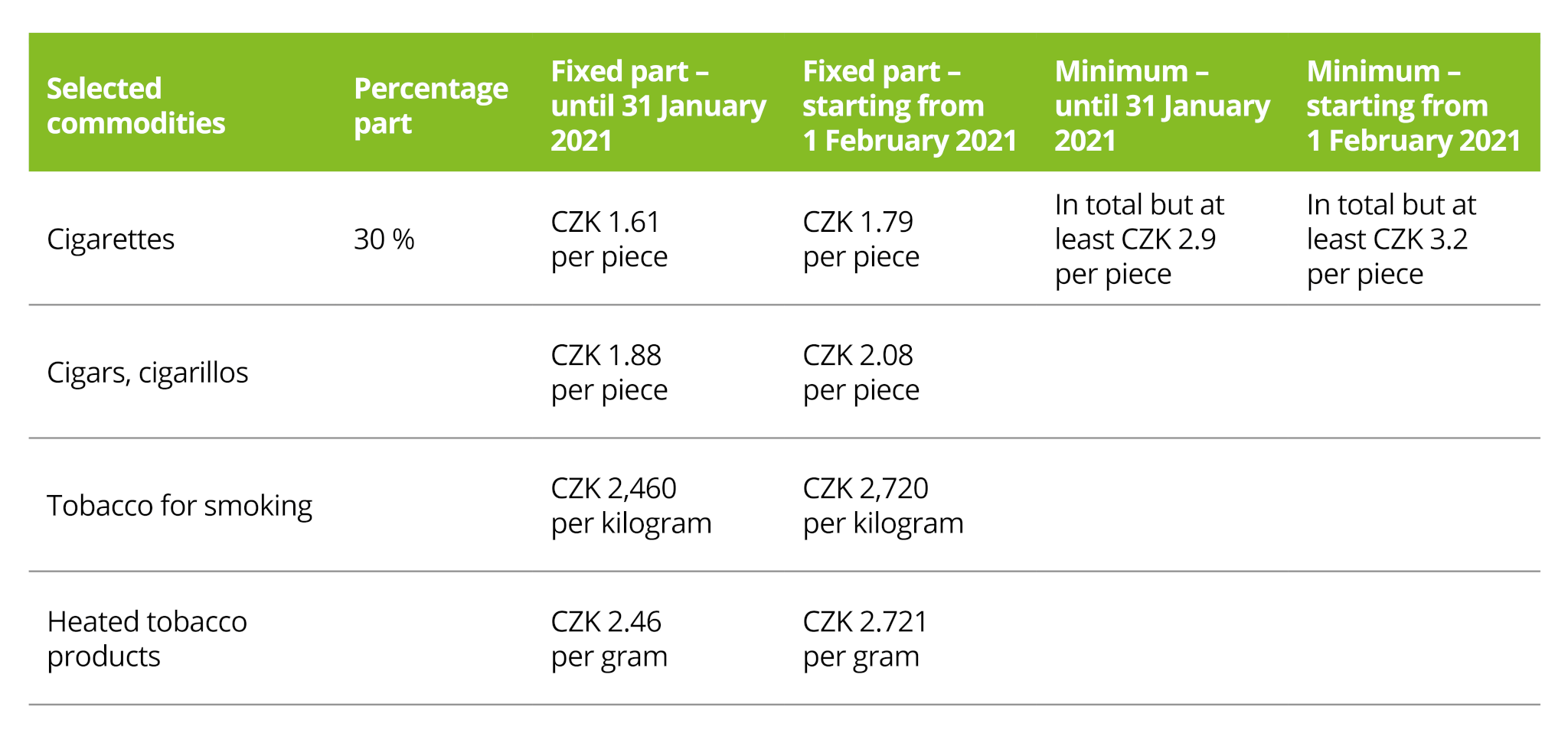

On the other hand, the excise tax rate on tobacco commodities increased with regard to both the fixed and percentage part of the tax. The increase in tax rates will be gradual: the first increase will be effective as of 1 February 2021; further increases will be effective as of 1 January 2022 and 1 January 2023. The table below shows the changes in the tax rates, which will take effect as of 1 February 2021.

On the basis of the tax package, the Act on the Mandatory Labelling of Spirits was also amended. Significant changes include, for example, the introduction of differentiation of the deposit amount provided by an alcohol distributor or the possibility of changing the registered alcohol distributor to another alcohol distributor who is their related person, provided this alcohol distributor meets the registration conditions. Furthermore, the amendment introduces new notification obligations.

If you are interested in more details, please do not hesitate to contact us.