Tax Transfer prices constantly on the radar of tax administration

The issue of transfer pricing is considered to be highly risky by the Czech tax administration and therefore it has been focusing on it in the long term during tax inspections. This trend is also confirmed by the results of tax inspections focused on transfer prices, recently published by the tax administration in a joint press release with the Ministry of Finance of the Czech Republic.

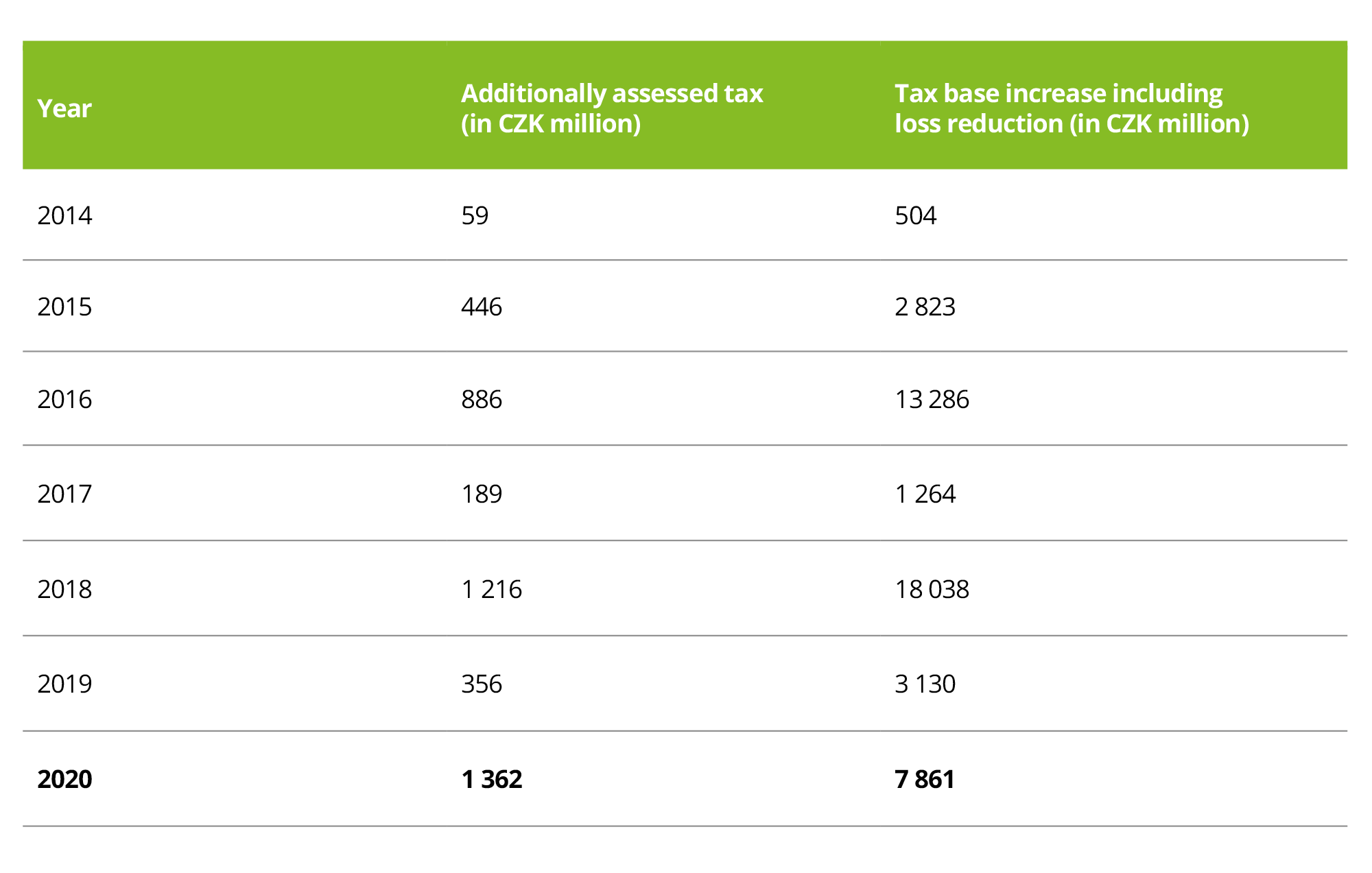

Over the last 7 years, the tax administration has carried out over 2,400 tax inspections, which have increased the tax base by almost CZK 47 billion purely in relation to transfer prices and resulted in an additional tax assessment of CZK 4.5 billion. 2020, while affected by the covid-19 pandemic, was no exception in this area. This year, the tax administration carried out 249 special inspections focused on transfer prices and assessed the additional tax at CZK 1.4 billion. This represents the highest annual assessment in connection with transfer prices in the seven-year horizon. An overview of the additionally assessed tax and the increased tax base in connection with transfer pricing inspections is presented in the table below.

Errors in setting the transfer prices with related parties are currently one of the most common findings in corporate income tax inspections. The tax administration points out that there are, for example, shortcomings in the provision of consultancy services within a group, where the taxpayer does not succeed in proving the provision of such services or their benefit, or their price is considered disproportionate by the tax administrator. Another problematic area, according to the tax administration, is also the erroneous set-up of transfer prices in the case of a Czech manufacturing subsidiary, where the parent company takes decisions on the prices of its production and customers and such a subsidiary incurs losses.

However, the tax administration does not only point to the punitive side of the issue, but also to a preventive effect in the area of transfer pricing. It thus reminds of the possibility and advantageousness of using the so-called institute of advance pricing agreement (where the taxpayer asks the financial administration in advance to assess the transfer pricing set-up) as a suitable tool for preventing tax inspections.