This article provides a high-level overview of the new and revised Standards and Interpretations that are effective for the December 2020 calendar year-end and subsequent accounting periods.

Entities are, however, generally permitted to adopt the new and revised Standards and Interpretations in advance of their effective dates (refer to individual Standards and Interpretations for additional details).

A word of caution regarding early adoption of Standards and Interpretations in the case of entities that prepare financial statements under IFRS as adopted by the European Union (EU). Standards, Interpretations and amendments to the existing standards, which were not endorsed for use in the EU, cannot be applied by the entities preparing their financial statements in accordance with IFRS as adopted by the EU.

Where applicable, we have made reference to past issues of Accounting News dealing with the specific Standard or Interpretation in greater detail. These past newsletters are also available at dReport.cz. As always, entities should refer to the Standards and Interpretations themselves to identify all of the changes that may affect their particular circumstances.

Where a Standard or Interpretation is adopted in advance of its effective date, disclosure of that fact is generally required.

Even where there is no intention to implement a Standard or Interpretation in advance of its effective date, entities need to be aware of new Standards and Interpretations as they are issued, in order to comply with the requirement included in IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors to disclose in their financial statements the potential impact of Standards and Interpretations in issue but not yet effective. This requirement is valid irrespective of whether a Standard or Interpretation has already been endorsed in the EU.

We therefore recommend reviewing further newly issued amendments to standards and interpretations that will be approved by the date of the issuance of a company’s financial statements. We will be providing updates on these developments on www.iasplus.com and in our Accounting News.

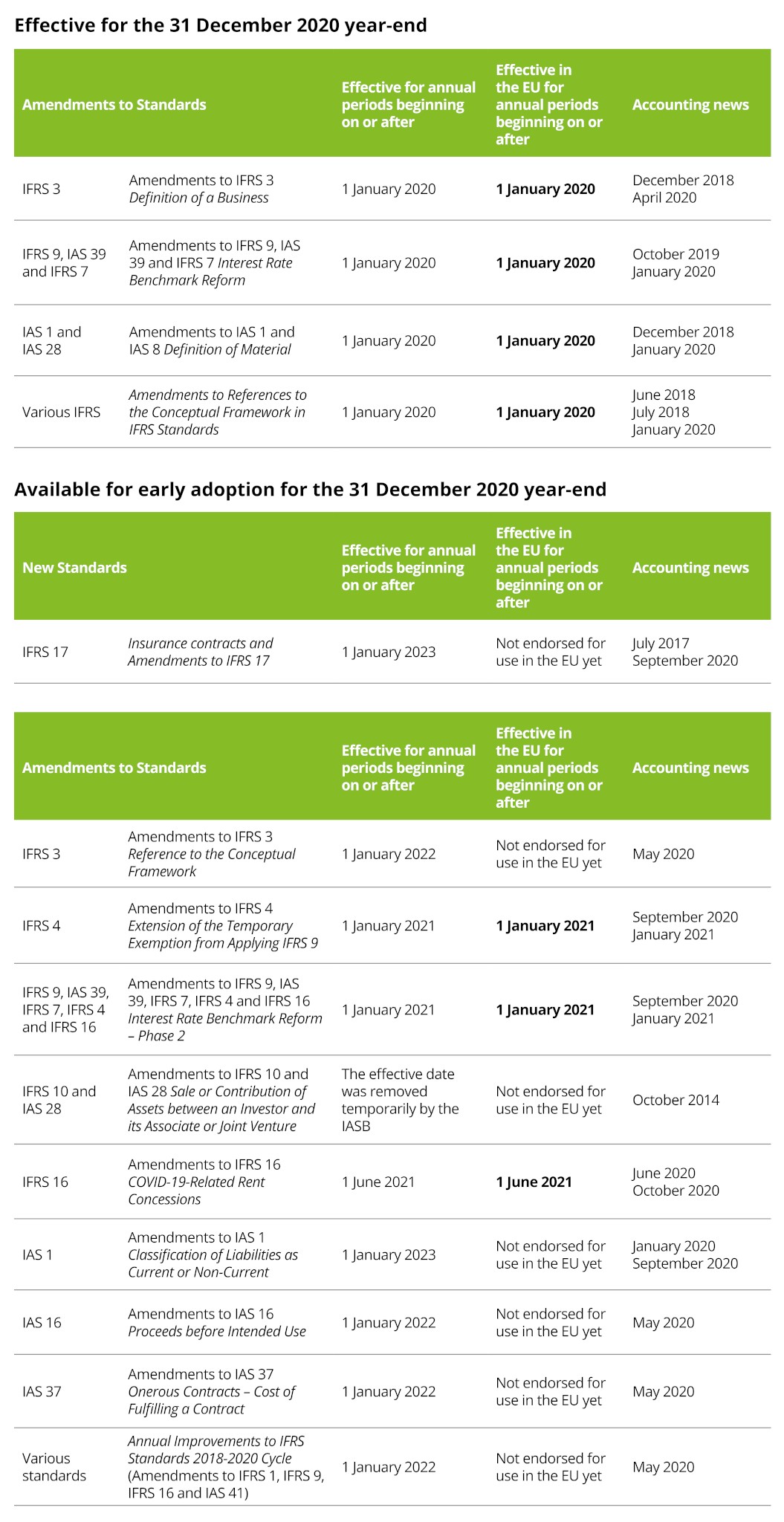

The effective dates of IFRSs issued by the IASB and IFRSs as adopted by the EU can be different.

New and Revised Standards

The following tables provide a list of new and revised Standards in issue as of 20 January 2021 that are either effective, or available for early adoption, for 31 December 2020 calendar year-end.

All of the newsletters referred to may be found here.

In the special edition of IFRS in Focus – Closing out 2020, you can find financial reporting issues that may be relevant for years ending on or after 31 December 2020 as a result of challenges related to COVID-19, areas of regulatory focus, the current economic environment or changes in accounting standards.

This 17-page publication covers the following topics:

- Judgements and estimates

- Going concern

- Presentation of COVID-19-related items in the statement of profit or loss

- ‘Non-GAAP’ or alternative performance measures

- Liquidity risk management

- Expected credit losses

- Impairment reviews

- IFRS 16 Leases

- IFRS 15 Revenue from Contracts with Customers

- Information on an entity’s financing activities

- Reporting the effects of income tax

- Brexit and 2020 financial statements

- Interest Rate Benchmark Reform

- Climate change

- Currency and hyperinflation

Sources: IFRS in Focus – Closing out 2020, www.iasplus.com