The year-end is approaching, which entails financial statements for those companies whose reporting period corresponds to the calendar year. The financial statements involve a number of procedures, referred to as closing operations, including an accurate measurement of assets and liabilities as of the balance sheet date. The accurate measurement of assets and liabilities denominated in a foreign currency also involves their remeasurement as of the balance sheet date. This article aims to summarise basic procedures and draw attention to some remeasurement issues.

The Accounting Act stipulates that assets disclosed under Section 4 (12) of the Accounting Act need to be remeasured using the exchange rate promulgated by the Czech National Bank (hereinafter the “CNB”). Entities having a duty to calculate “unrealised foreign currency translation gains and losses” and reflect them in the value of assets and liabilities denominated in a foreign currency.

What is remeasured and how it is accounted for

Remember that aside from receivables and payables, shares in business corporations, rights arising from securities and book-entry securities and derivatives, stamps and vouchers denominated in foreign currencies and foreign currencies as such, assets to be remeasured also include provisions, reserves and technical reserves if the related assets and liabilities are denominated in a foreign currency. Reserves and provisions will be in focus in the below paragraphs. In particular, approaches to the remeasurement of provisions stir up a great deal of emotions in practice; the example below shows that experts’ opinions vary.

Unrealised foreign currency translation gains or losses as of the balance sheet date are usually accounted for under financial expenses or income on accounts 563 or 663 – this relates to receivables, payables, stamps and vouchers, foreign currency treasury and foreign currency accounts.

Remeasurement of equity investments, i.e. shares in subsidiaries and associates, are recognised on equity accounts in accounting group 41, often on account 414 – Gains or losses from the remeasurement of assets and liabilities. This is not a black-and-white approach, whereby various expert opinions exist in practice. This topic will be discussed in detail in some of our future articles.

Debt securities, i.e. securities held to maturity, will be remeasured using the CNB’s exchange rate as of the balance sheet date by means of financial income or financial expenses in accounting groups 56 and 66.

Foreign exchange gains or losses relating to securities measured at fair value and equity-accounted investments are part of the fair value measurement or equity method of accounting. A change in the fair value of securities available for sale is recognised on equity accounts in accounting group 41. A change in the fair value of equity or debt securities held for trading is recognised under financial expenses or financial income.

Remeasurement of provisions and reserves

Provisions and reserves created for assets or liabilities denominated, pursuant to Section 4 of the Accounting Act, in both CZK and a foreign currency must be accounted for in the same currency as of the date of the accounting event and, furthermore, remeasured using the CNB’s exchange rate as of the balance sheet date.

It is necessary to decide how the foreign exchange gains or losses will be accounted for as of the balance sheet date with regard to the remeasurement of provisions.

In line with a decision passed in 2005 by the Coordination Committee, which no longer exists, the Ministry of Finance is of the opinion that these foreign exchange gains or losses are part of the value of the provision, which is why the remeasurement should be accounted for on accounts of accounting group 55 (such as accounts 558 and 559).

It is often the case that foreign exchange gains or losses arising from the remeasurement of a provision as of the balance sheet date are recognised on the accounts of financial expenses and financial income (such as on account 563 and 663). This entails the risk that unrealised foreign currency translation gains or losses relating to the provisions that are not created under a special regulation and, as a consequence, are not tax-deductible as such, will be included in tax-deductible expenses. See the following example demonstrating the key context.

Example

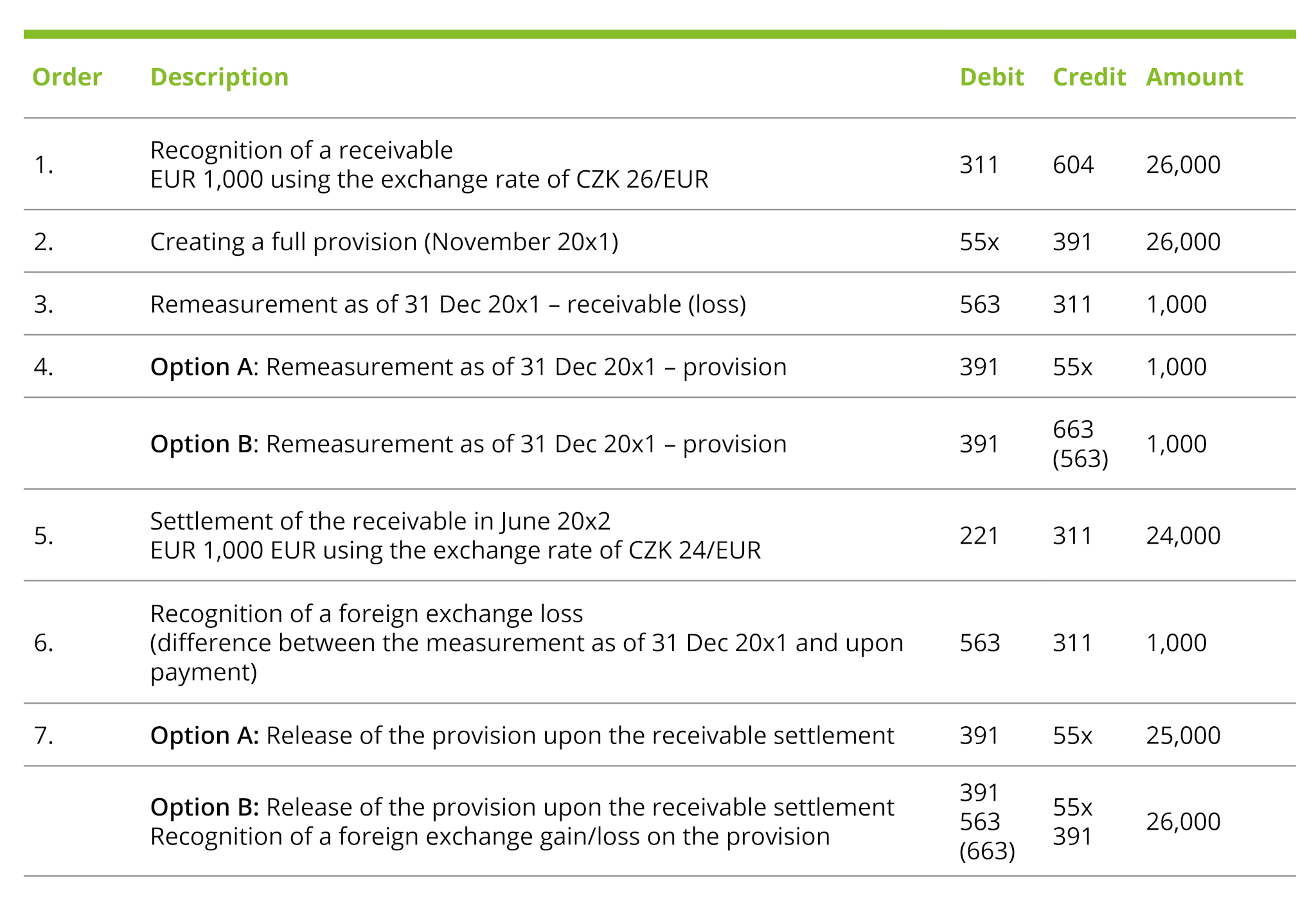

In 20×1, an entity recognised a receivable from the sale of goods in the amount of EUR 1,000 using the exchange rate of CZK 26/EUR. The receivable was not settled until the end of the reporting period. Due to its knowledge of the market situation, the entity had doubts as to the recoverability of the receivable, which is why it recognised a full provision against this receivable in November 20×1, despite taking measures for its collection.

As of the balance sheet date (31 December 20×1), the exchange rate was CZK 25/EUR.

In June 20×2, the receivable was settled, using the exchange rate of CZK 24/EUR.

VAT is not considered for the sake of simplification.

How will these operations be accounted for and in which amounts?

The options disclosed above demonstrate the context as well as advantages and disadvantages:

- The demanding and time-intensive character of individual provisions against receivables for tax purposes;

- In reality, this relates not only to a provision and a payment covering two periods but frequently, it also involves a long history of the whole list of receivables affected by various movements in exchange rates, partial payments, etc.;

- Furthermore, one has to consider the time requirements for recording and monitoring receivables from sales, or other types of receivables (such as related-party receivables);

- An individually-recorded foreign exchange gain or loss on a provision may be simply disregarded in preparing a cash flow statement as an adjustment reflecting non-cash transactions;

- It is strenuous (yet not impossible) to keep a close eye on an accurate allocation of the foreign exchange gain or loss upon the recognition of a provision, its update and subsequent release; and

- Book-keeping has an inherent control mechanism as regards balance sheet account 391 and profit and loss account 55x which cannot be used in option B.

There is no clear conclusion in practice as to which course of action is correct. We can see pros and cons of both options.

- Which of the above options do you use?

- Is your approach formalised in internal policies?

- Do you use software for the selected approach to updates, including the remeasurement of provisions?

- Do you disclose the selected approach in the notes to the financial statements in the event that the impact is material?

Remeasurement of accruals/deferrals and estimated items

Remeasurement of temporary assets and labilities must also be considered. Pursuant to Interpretation of the National Accounting Council I-37 “Accruals/Deferrals and Foreign Currencies”, all temporary accounts that are a receivable or payable by nature have to be remeasured as of the balance sheet date. This means that as of the balance sheet date, account balances presented in item ‘Accrued income’ or ‘Estimated receivables’ and account balances in item ‘Accrued expenses’ or ‘Estimated payables’ have to be remeasured. Contrarily, the remeasurement of account balances in items ‘Deferred expenses’ (usually including comprehensive expenses) or ‘Deferred income’ would be inaccurate as cash flows have already been realised and these items are no longer exposed to any foreign exchange risk. In a wider context, reserves as an instrument for accrual accounting represent an item that will result in future cash outflow, i.e. is exposed to a foreign exchange risk, which is why it should be remeasured using the exchange rate as of the balance sheet date if the reserves concerned are settled in a foreign currency.

On-going remeasurement during the reporting period

As part of closing operations, it is necessary to ensure that foreign exchange remeasurement makes sense and does not cause any ungrounded overstatement of the movements on expense and income accounts. Typically, remeasurement made on a monthly basis during the year without cancelling the previous remeasurement may overstate the movements. In extreme cases, if there is no year-on-year change in closing exchange rates and the exchange rate was increasing in the first half of the year and decreasing in the latter half, the remeasured item should not result in any movements on the accounts of foreign exchange gains or losses. In practice, this inaccuracy is often caused by the setup of the accounting software.

This topic should not be underestimated; for example, foreign exchange gains are included in turnover for the purpose of categorising entities…

Foreign exchange gains or losses entail a great many problems. We recommend paying close attention to the closing processes concerning remeasurement, set up specific course of action in internal policies and minimise the risk of future issues arising from an incorrect remeasurement of assets and liabilities, including the risk of tax sanctions.