Sophisticated tactics have emerged in financial crime that challenge law enforcement and financial institutions. One such technique that has come to the fore is the use of money mules. These individuals (un)consciously play a key role in facilitating the movement of illegally obtained funds, often without being aware of the seriousness of their involvement.

Who are money mules?

A money mule is a person used by criminal entities to transfer and launder illegally obtained funds. This usually involves receiving money into their bank account and then forwarding it to another account or converting it into cryptocurrencies, often in exchange for a small commission. Such persons come from a wide variety of backgrounds and are often approached through online job advertisements, social networking sites or direct messages promising them easy earnings for minimal effort.

Modus operandi

This scheme exploits the financial vulnerability and ignorance of the participants. Criminals use a variety of tactics to lure these individuals into a trap:

- Online recruitment: Criminals post fake job offers on the internet, posing as legitimate companies looking for “financial agents” or “payment processors”. These positions are presented as high-paying opportunities. Often a “proper” contract is signed.

- Romance scams: Criminals establish romantic relationships online and then persuade their victims to accept and transfer money on their behalf, often under the guise of funding travel expenses or emergencies. However, the victim of romantic scams is often also the source of the fraudulently solicited funds.

- Mystery shopping/reshipping schemes: Scammers trick people into believing they are performing legitimate tasks such as mystery shopping or reshipping, with payments made through the bank accounts of the money mules.

Impact on financial crime

The use of money mules significantly assists criminals in achieving their illicit objectives:

- They help criminals break the “direct” link between the illegal source of funds and their ultimate target. This creates complex layers that make it difficult for law enforcement to trace the origin of the money.

- They play an important role in the money laundering process by converting “dirty” money into apparently legitimate funds. This allows criminals to enjoy their ill-gotten gains without arousing suspicion.

- They allow criminals to operate across borders without physically crossing them. This global nature of financial crime makes it difficult for the authorities to coordinate their efforts and track down the perpetrators.

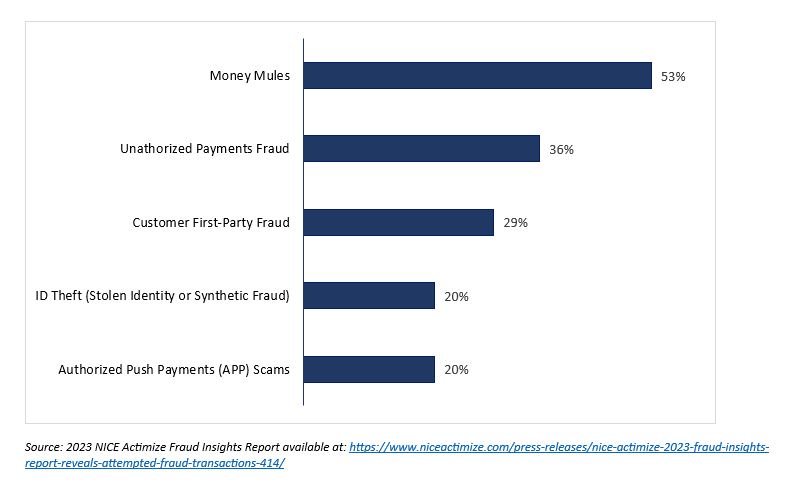

Money mules are an integral part of a complex financial crime network that serves as a bridge between illicit activities and legitimate financial systems. The following chart shows the statistics of the world’s fraud leaders. A report released by NICE Actimize, “2023 FRAUD INSIGHTS REPORT”, details the challenges that currently pose the greatest fraud threat to financial institutions. Based on this report, these are money mules.

A concerted effort by individuals, financial institutions and law enforcement agencies is essential to reduce the impact of money mules on financial crime. The importance of raising awareness and implementing effective preventive measures cannot be underestimated.