IFRS EU endorsement process [June 2024]

The European Financial Reporting Advisory Group (EFRAG) updated its report showing the status of endorsement of each IFRS, including standards, interpretations, and amendments, most recently on 31 May 2024.

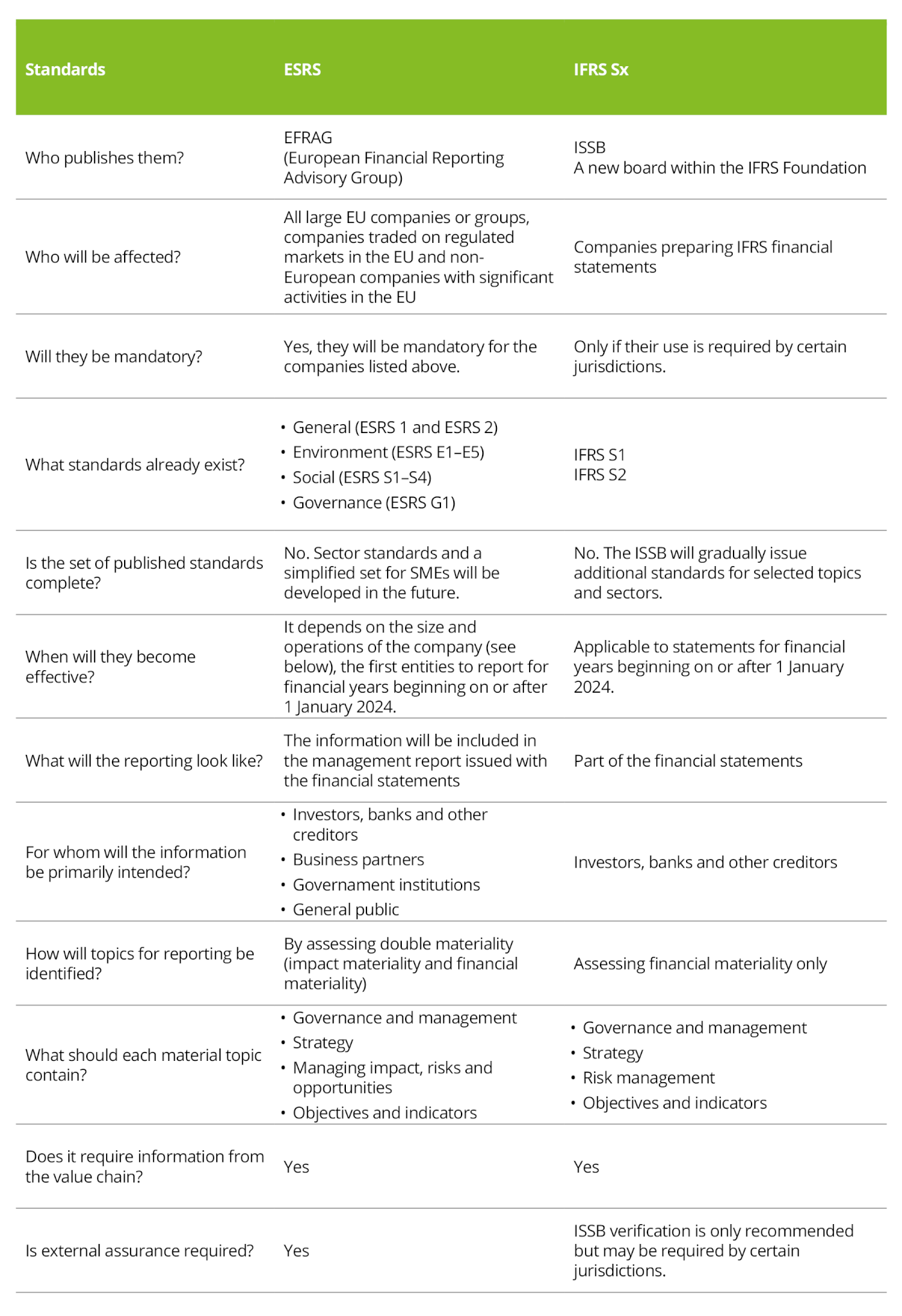

Sustainability has been a topic of growing importance for quite some time and has recently transitioned from technical discussions centred on reducing carbon footprint and conserving natural resources to also encompass reporting. Beginning next year, certain companies will be required to disclose non-financial reporting under the European CSRD. Additionally, the IFRS Foundation has published its own standards for reporting non-financial information. How do these two sets of standards differ, and which entities are affected?

At the end of 2022, the European Union adopted the Corporate Sustainability Reporting Directive (CSRD), which will require reporting in accordance with the European Sustainability Reporting Standards (ESRS). However, the trend towards standardisation of non-financial information extends beyond the EU. The IFRS Foundation, which had already established the International Sustainability Standards Board (ISSB) in late 2021, and the US Securities and Exchange Commission (SEC), which is currently in the process of formulating its own regulations for climate-related disclosures, have also embraced this direction.

The CSRD aims to harmonise the publication of sustainability-related information, ensuring its comparability and reliability. Simultaneously, the EU endeavours to elevate non-financial information to the same level of importance as financial data, as assessing a company’s performance and its ability to continue as a going concern in the long term would be impossible without it. The IFRS Foundation also advocates the same idea. Consequently, two sets of standards are in development – ESRS and IFRS Sx.

A detailed comparison of ESRS and ISSB standards is available on the EFRAG website.

The main requirements of the CSRD include:

According to the CSRD requirements, large public interest entities will have to report for the first time in 2025 and other large companies in 2026. The overall plan for the gradual transition to CSRD is as follows:

o assets of at least EUR 20 million;

o turnover of at least EUR 40 million; and

o more than 250 employees.

The good news for companies subject to both ESRS and the standards issued by the ISSB is that these two institutions collaborate closely to ensure that their requirements are as consistent as possible, thus avoiding a double burden.

The Global Reporting Initiative, known for its voluntary but widely adopted GRI standards globally, should not be excluded from the list of institutions contributing to the development of sustainability standards. These standards reflect the current best practices in reporting, and EFRAG has drawn inspiration from them in many aspects while developing the ESRS. The GRI is actively participating in the development of both the ESRS and the ISSB standards.

The SASB standards, which have offered a framework for investor disclosure since 2011, are also noteworthy. SASB joined the IFRS Foundation in 2022 and will serve as the basis for additional standards issued by the ISSB.

The disclosure of sustainability-related information is undergoing a significant shift towards greater standardisation and legal requirements. Nevertheless, numerous companies already possess experience in voluntary sustainability reporting, and the collaboration and interconnection among various standard-issuing institutions will enable them to leverage this experience.

Seminars, webcasts, business breakfasts and other events organized by Deloitte.