IFRS EU endorsement process [June 2024]

The European Financial Reporting Advisory Group (EFRAG) updated its report showing the status of endorsement of each IFRS, including standards, interpretations, and amendments, most recently on 31 May 2024.

The following article briefly summarises the key points of the National Accounting Board’s updated interpretation I-8 Social Fund and Similar Funds from Profit.

The interpretations express the National Accounting Council’s professional opinion on the practical application of Czech accounting rules. The aim of the interpretations is to contribute to the formulation of optimal and uniform policies in the field of accounting and financial reporting. They deal primarily with issues that are not addressed by the Czech accounting regulations or are addressed insufficiently, and areas that are addressed inconsistently in the accounting practice.

Although the interpretations are not legally binding, the Supreme Administrative Court has accepted them several times as a valuable source of supplementing accounting legislation.

Interpretation I-8 (hereinafter the “Interpretation”) was issued in 2006 and updated in April 2023.

Some companies create special funds made up of profits to cover employee benefits or loans to employees (hereinafter referred to as the “social fund”) in accordance with their articles of association or similar documents.

The updated Interpretation essentially addresses two issues:

The original version of the 2006 Interpretation allowed for the use of the balance sheet approach to accounting for drawdowns from the social fund, where employee benefit entitlements were charged directly against the social fund. However, this approach led, among other things, to inconsistencies in the financial statements of companies that did and did not establish social funds.

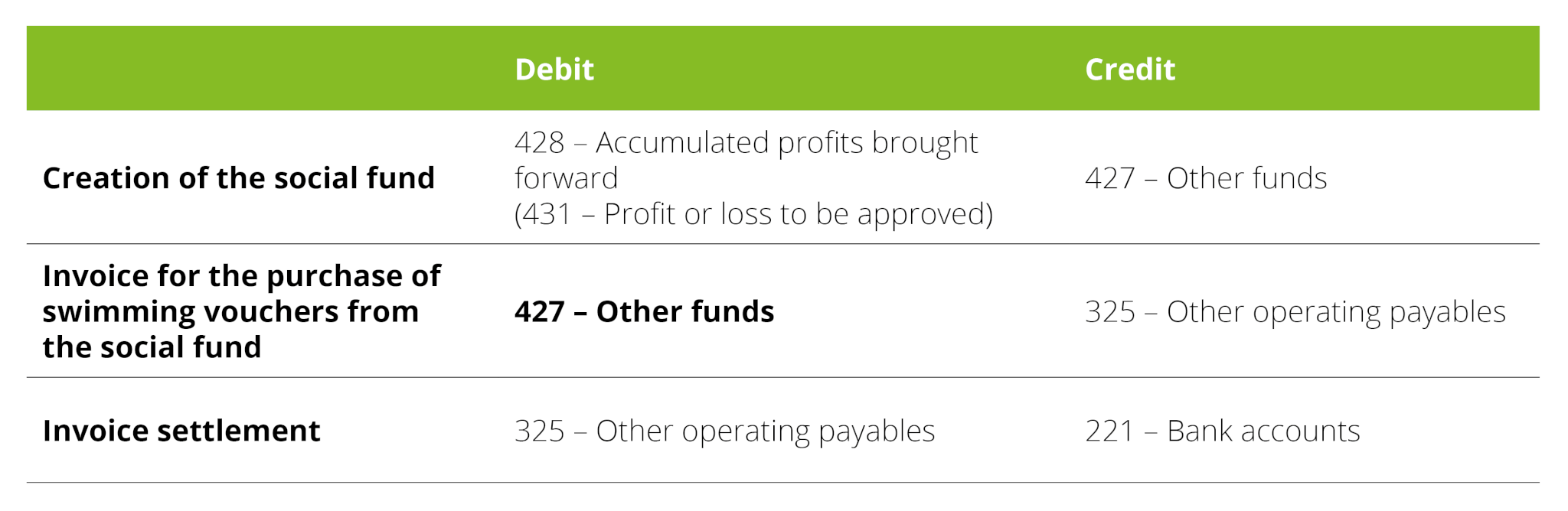

Example of accounting before the Interpretation was updated:

The updated interpretation is based on the premise that entitlements to employee benefits are always an expense because they represent remuneration for the work performed, similar to wages. It is therefore irrelevant whether or not a social fund is used to cover the benefit. If the social fund is used, under the Interpretation, it is reduced and the relevant amount is credited to accumulated profits brought forward.

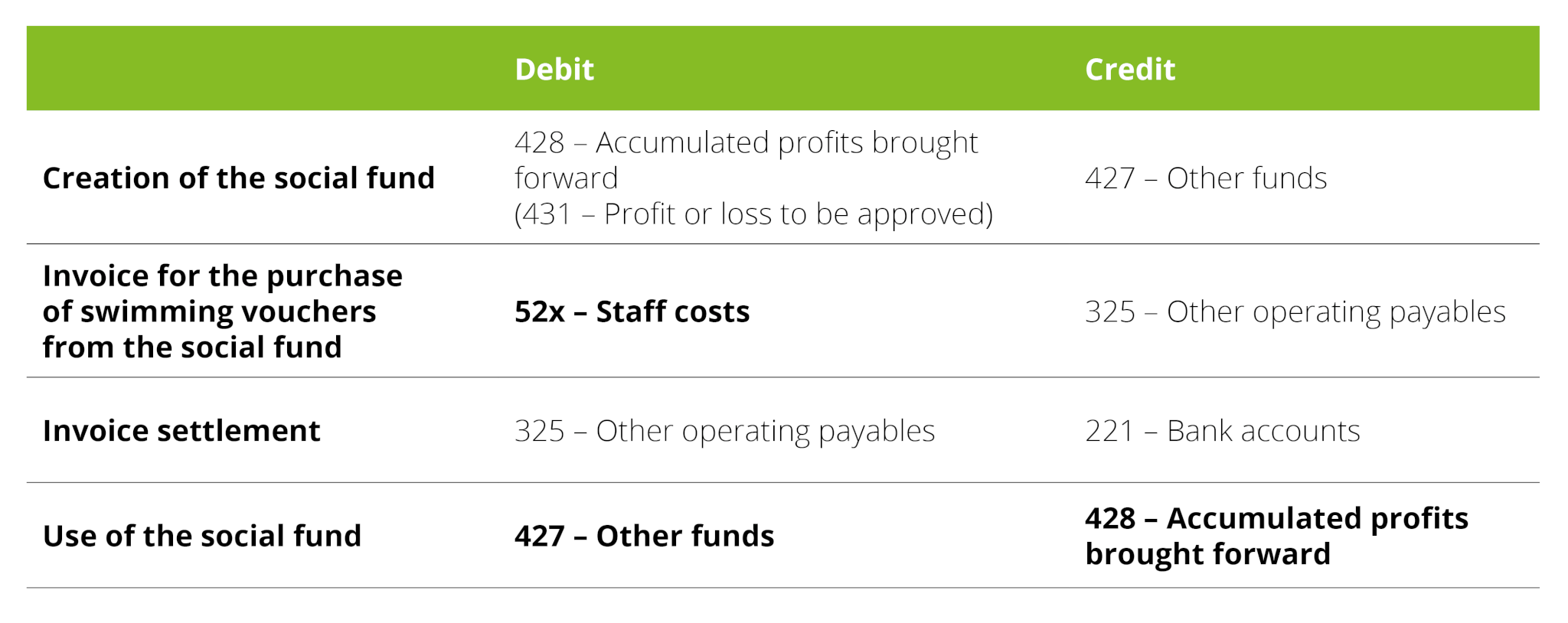

Example of accounting after the Interpretation update:

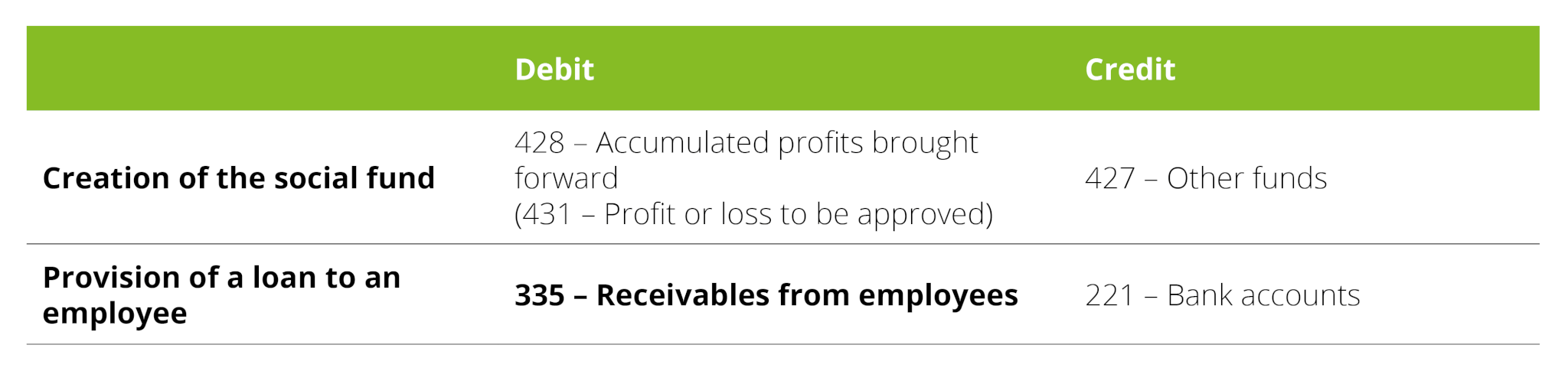

According to the updated Interpretation, the provision of a loan to employees from the social fund is not an expense but a receivable from employees and the social fund is not reduced and continues to represent a portion of accumulated profits that cannot be distributed to shareholders. The Interpretation recommends the use of a sub-ledger account to record the loans granted.

Example of accounting after the Interpretation update:

The Interpretation also notes that when a company prepares a statement of changes in equity, the use of the social fund is reflected in that statement. If it does not prepare the statement, changes in the social fund are described in the notes to the financial statements.

The social fund is generally set up to finance employee benefits. The selected benefit may represent exempt income for the employee under the Income Tax Act, provided that it is paid from the cultural and social needs fund, the social fund or charged to non-tax deductible expenses. Thus, whether the entity accounts under the balance sheet approach or the newly proposed profit and loss accounting, the Income Tax Act gives the option to exempt such an employee benefit.

However, taxation or tax deductibility of employee benefits charged to account 52x depends on the type of employee benefit and its tax treatment under the Income Tax Act. In this context, we would also like to point out that the upcoming amendment to the Income Tax Act for 2024 under the so-called Recovery Package fundamentally changes the area of employee benefits.

Seminars, webcasts, business breakfasts and other events organized by Deloitte.