As we have informed you in previous articles, R&D tax deductions are increasingly more often examined by the tax administration. The growing number of audits, which often result in legal disputes, leads to uncertainty among taxpayers. It is therefore questionable whether the setup of the deduction aimed at supporting research and development is the only accurate solution and whether it is time to consider an adjustment thereto, also considering the fact that the area has not been modified since 2005.

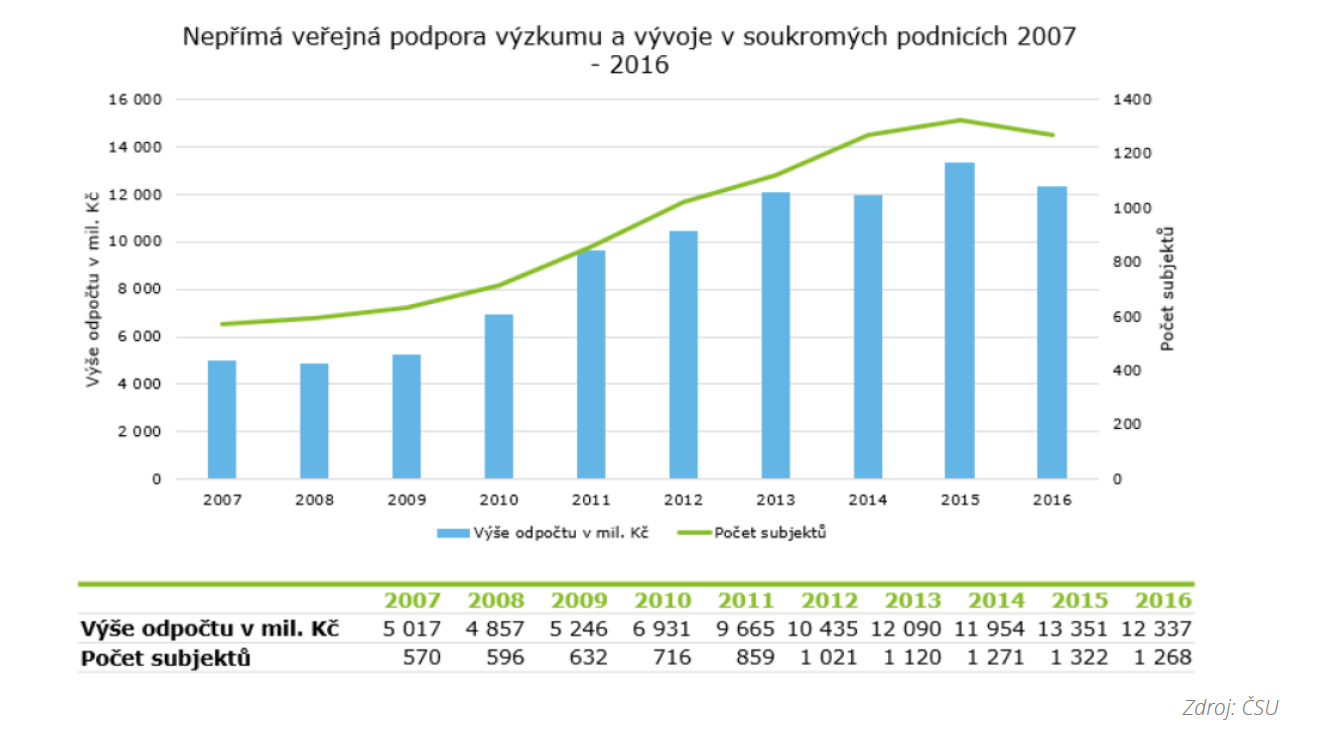

A decrease in the number of entities using the R&D tax deduction between 2015 and 2016 as well as a decrease in the aggregate costs reported by businesses as part of the R&D tax deduction in the same period proves the growing uncertainty among companies engaged in research and development in the Czech Republic arising from the tax administration’s approach to the audit of tax deductions. This is alarming especially due to the fact that the decrease was recorded for the first time since 2005 when the R&D tax deduction was incorporated into legislation and also with regard to the boom in the Czech economy at present.

We consider it problematic that formal project elements are currently preferred to the fact whether the company conducts research and development. Rather contradictory statutory requirements placed upon the research and development project documentation pose another issue. This includes, on one hand, the definition and approval of research and development activities prior to their commencement when the taxpayer does not (and cannot) have detailed solution descriptions as well as a sufficiently accurate and detailed definition of activities, including their timing, budget, staffing etc, on the other hand.

The current setting and practice bring about a great deal of uncertainty and disputes regarding the project commencement, factual definition of project activities and the onset or clarification of research and technical uncertainty.

Inspiration for potential changes in the setup of R&D deduction may be found abroad. In many countries having the R&D deduction in place, R&D projects are only processed retrospectively, subsequent to the termination of the respective taxation period and the relevant development task. This change could resolve persistent disputes between businesses and the tax administration concerning the definition of the term “project solution commencement”. Furthermore, it could enable tax payers to specify in greater detail how exactly project activities were realised in the respective period which could ultimately be beneficial for the tax administration in assessing eligible activities.

The latest information indicates that the financial administration is considering certain changes in the setup of R&D deductions. Let us hope that these changes will support research and development in the Czech Republic, contribute to the more-transparent assessment of R&D activities and direct attention to the actual substance of the issue rather than to the fact whether or not companies are really engaged in research and development. Greater transparency in R&D deduction is important for both companies operating in the Czech Republic and businesses considering the establishment of new or expanding existing R&D centres in the CE region and contemplating in which CE country the centre should be located. The transparency of individual support regimes in the relevant countries is one of the key factors in this decision-making process which is crucial for whether or not the Czech Republic will be selected.

In view of the Czech Republic’s efforts to support primarily investments with high added value, it should be essential for all of us that the R&D deduction setup become more transparent for businesses.

We will keep you updated on further developments in future dReport issues.

The article is part of dReport – May 2018, Tax news; Grants and investment Incentives