IFRS EU endorsement process [June 2024]

The European Financial Reporting Advisory Group (EFRAG) updated its report showing the status of endorsement of each IFRS, including standards, interpretations, and amendments, most recently on 31 May 2024.

From 1 January 2023, the amendments to IAS 1 Presentation of Financial Statements and IFRS Practice Statement 2 Making Materiality Judgements titled Disclosure of Accounting Policies are effective. In this article, we will take a closer look at the changes brought about by these amendments and also show an example of their application.

The amendments were issued by the International Accounting Standards Board (IASB) in March 2021. A year later, they were endorsed by the European Commission for use in the European Union.

We wrote about the changes in IAS 1 that the amendments bring in the article IASB finalised amendments to IAS 1 and the Materiality Practice Statement. We will now focus on how the new rules should be applied in order to achieve their main purpose – to help entities reduce immaterial accounting policy disclosures in their financial statements. We will also take a closer look at the guidelines in IFRS Practice Statement 2. This Practice Statement is not part of IFRS, and therefore its official translation into Czech is not available.

By the end of 2022, paragraph 117 of IAS 1 stated that an entity shall disclose its significant accounting policies without specifying the term ‘significant’. As of 1 January 2023, an entity shall disclose material accounting policy information, which is further specified: “Accounting policy information is material if, when considered together with other information included in an entity’s financial statements, it can reasonably be expected to influence decisions that the primary users of general purpose financial statements make on the basis of those financial statements.”

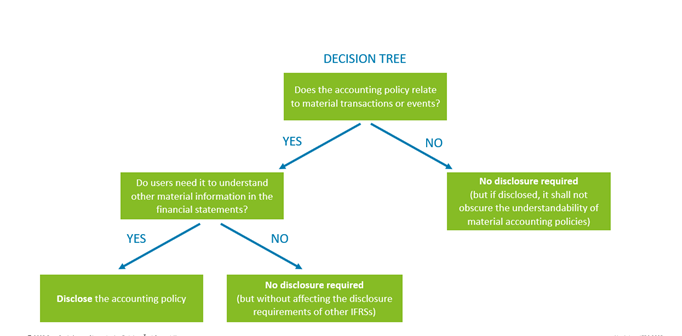

Several new paragraphs have been added to IAS 1, the application of which can be summarized in a simplified way in the decision tree:

Pursuant to paragraph 117B, an entity will be is likely to consider accounting policy information material to its financial statements if that information relates to material transactions, other events or conditions (an example of Deloitte is always given in brackets):

Note: Any specific disclosure of the accounting policy required by an IFRS is subject to materiality judgements. For example, IAS 16.73 requires an entity to disclose the measurement bases used for determining the gross carrying amount of property, plant and equipment. Such a disclosure would need to be provided only if the information resulting from that disclosure was considered material.

Paragraph 117C of IAS 1 emphasises that accounting policy information that focuses on how an entity has applied IFRS requirements to its own circumstances provides entity-specific information that is more useful to users of the financial statements than standardised information, or information that only duplicates or summarises the IFRS requirements. This idea is discussed in more detail in IFRS Practice Statement 2: Making Materiality Judgements, which states that entity-specific accounting policy information is particularly useful when that information relates to an area for which an entity has exercised judgement – for example, when an entity applies an IFRS differently from similar entities in the same industry.

According to IFRS Practice Statement 2, material accounting policy information could sometimes include information that is standardised, or that duplicates or summarises the IFRS requirements. Such information may be material if, for example:

IFRS Practice Statement 2 also includes the following example to illustrate the application of the above requirements.

Example S—making materiality judgements and focusing on entity-specific information while avoiding standardised (boilerplate) accounting policy information

Background

An entity operates within the telecommunications industry. It has entered into contracts with retail customers to deliver mobile phone handsets and data services. In a typical contract, the entity provides a customer with a handset and data services over three years. The entity applies IFRS 15 Revenue from Contracts with Customers and recognises revenue when, or as, the entity satisfies its performance obligations in line with the terms of the contract. The entity has identified two performance obligations and related considerations:

a) the handset – the customer makes monthly payments for the handset over three years; and

b) data – the customer pays a fixed monthly charge to use a specified monthly amount of data over three years.

For the handset, the entity concludes that it should recognise revenue when it satisfies the performance obligation (when it provides the handset to the customer). For the provision of data, the entity concludes that it should recognise revenue as it satisfies the performance obligation (as the entity provides data services to the customer over the three-year life of the contract).

The entity notes that, in accounting for revenue it has made judgements about:

a) the allocation of the transaction price to the performance obligations; and

b) the timing of satisfaction of the performance obligations.

The entity has concluded that revenue generated from these contracts is material to the reporting period.

Application

The entity notes that for contracts of this type it applies separate accounting policies for two sources of revenue, namely revenue from:

a) the sale of handsets; and

b) the provision of data services.

Having identified revenue from contracts of this type as material to the financial statements, the entity assesses whether accounting policy information for revenue from these contracts is, in fact, material.

The entity evaluates the effect of disclosing the accounting policy information by considering the presence of qualitative factors. The entity noted that its revenue recognition accounting policies:

a) were unchanged during the reporting period;

b) were not chosen from accounting policy options available in the IFRS Accounting Standards;

c) were not developed in accordance with IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors in the absence of an IFRS Standard that specifically applies; and

d) are not so complex that primary users will be unable to understand the related revenue transactions without standardised descriptions of the requirements of IFRS 15.

However, some of the entity’s revenue recognition accounting policies relate to an area for which the entity has made significant judgements in applying its accounting policies – for example, in deciding how to allocate the transaction price to the performance obligations, and the timing of revenue recognition.

The entity considers that, in addition to disclosing the information required by paragraphs 123–126 of IFRS 15 about the significant judgements made in applying IFRS 15, primary users of its financial statements are likely to need to understand related accounting policy information. Consequently, the entity concludes that such accounting policy information could reasonably be expected to influence the decisions of the primary users of its financial statements. For example, understanding:

a) how the entity allocates the transaction price to its performance obligations is likely to help users understand how each component of the transaction contributes to the entity’s revenue and cash flows; and

b) that some revenue is recognised at a point in time and some is recognised over time is likely to help users understand how reported cash flows relate to revenue.

The entity also notes that the judgements it made are specific to the entity.

Consequently, material accounting policy information would include information about how the entity has applied the requirements of IFRS 15 to its specific circumstances.

The entity, therefore, assesses that accounting policy information about revenue recognition is material and should be disclosed. Such disclosure would include information about how the entity allocates the transaction price to its performance obligations and when the entity recognises revenue.

Seminars, webcasts, business breakfasts and other events organized by Deloitte.